Banks continuously seek improvements in using marketing analysis to attract and retain customers, and to expand the financial products used by existing customers.

A new report by the Aite Group, a Boston-based research and advisory firm focused on the financial-services industry, suggests an overlooked pattern that could add to a bank’s bottom line: The customers’ level of activity in their own financial affairs yields more potential for broadening the relationship with the bank than segments such as “young professionals” or “empty-nesters.”

In the report released this month, “A Behavioral Segmentation of Banking Customers,” author Ron Shevlin zeroes in on why a certain customer has a broader relationship with a bank than other customers.

“I don’t think bankers think about people who are more engaged in their financial activity,” said Shevlin, an Aite senior analyst. “If customers are not highly engaged in their own financial management, making them more offers isn’t going to make them a better customer or get them more engaged in the banking relationship.”

Instead of market analysis based on more traditional segments using demographics such as age and lifestyle, the report segments consumers into three groups, based on involvement in their own financial management: highly active, moderately active and inactive.

The report is based on Aite’s survey of 1,115 U.S. consumers representing the overall age, income, geographic and gender distribution of the U.S. The survey was conducted in the second quarter of 2012.

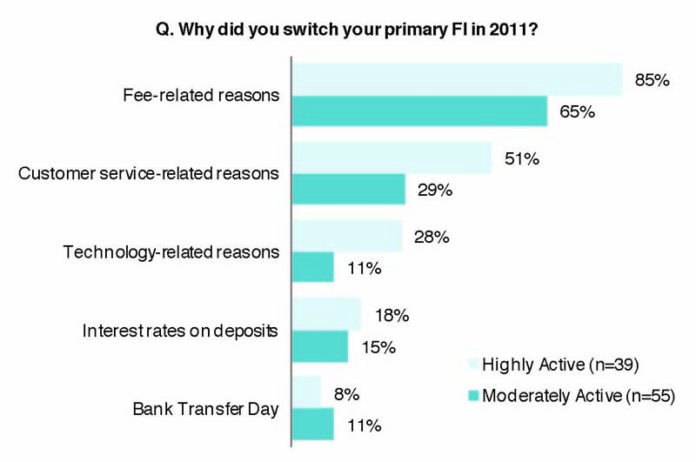

What the findings boil down to is that two bank customers who have a similar experience will have a different reaction based on level of financial engagement.

“If a customer who is highly engaged in his financial life has a bad service experience, he is more likely to leave the bank,” Shevlin said.

The valuable part of the report’s finding, in terms of marketing, is that a customer highly engaged in personal financial matters who has a positive banking experience is more likely to add more banking products and services. So that’s where banks should focus more marketing resources, Shevlin said.

That expansion of customer engagement with a bank starts best at the beginning of the relationship, said Andera Senior Vice President for Marketing Laurie McLachlan.

Providence-based Andera provides technology for online account opening and loan origination for financial institutions.

“It’s not so much the demographics that determine a customer’s profitability. The bank earns money, basically, in three ways: from fees, as in overdrafts; from floats, or the balances in the account; and from interchange, or how often the customer uses their debit or credit card,” McLachlan said. “All three are driven by customer behavior.”

A highly involved banking consumer is called a “financial maximizer,” she said.

“There’s definitely a segment of the population that’s like that. They’re very active. They maximize the use of their credit cards to get the most rewards,” McLachlan said. “But there are a whole lot of people who ‘set it and forget it.’ They say they’re dissatisfied with their institution but they still won’t move.”

Those inactive customers are not the bank’s most potentially valuable customers, Shevlin said.

“If a bank takes good care of a highly active consumer, they’re going to drive a lot of business to the bank,” Shevlin said. “But if they don’t take care of them, they’re going to be out the door.” •