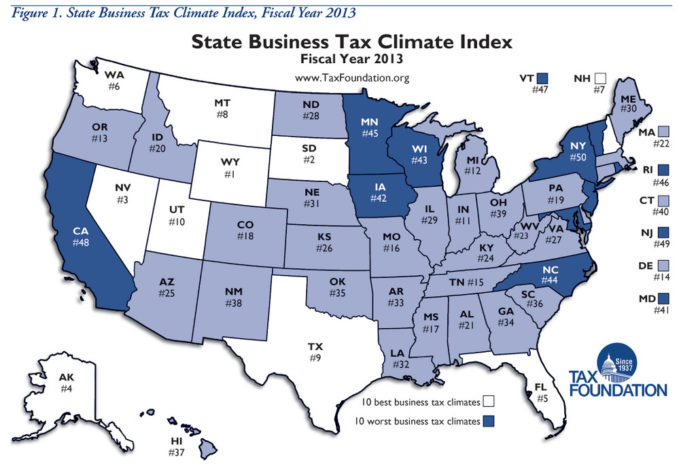

WASHINGTON – Rhode Island again ranked among the worst states on the Tax Foundation’s 2013 State Business Tax Climate report.

The Ocean State ranked 46th on the non-partisan tax policy research group’s list, pulling ahead of only Vermont, California, New Jersey and New York.

The state also ranked 46th on the 2012 report, a slight improvement from its 47th place rating in the 2011 ranking.

Rhode Island’s 2013 score included:

- Corporate tax rank, 42.

- Individual income tax rank, 37.

- Sales tax rank, 25.

- Unemployment insurance tax rank, 50.

- Property tax rank, 46.

“The lesson is simple: a state that raises sufficient revenue without one of the major taxes will, all things being equal, have an advantage over those states that levy every tax in the state tax collector’s arsenal.,” said economists Scott Drenkard & Joseph Henchman, authors of the 2013 State Business Tax Climate Index, which represents the tax climate of each state as of July 1, 2012.

According to the Tax Foundation, the bottom 10 states in the report’s listing suffer from “complex, non-neutral taxes, with comparatively high rates.”

The states ranking in the top 10 – Wyoming, South Dakota and Nevada were the top three, respectively – showed an absence of a major tax.

“Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate tax, the individual income tax, or the sales tax,” said the report.

Massachusetts ranked 22 overall, with a corporate tax rank of 33, an individual income tax rank of 15, a sales tax rank of 17, an unemployment insurance tax rank of 49 and a property tax rate of 47.

“Tax competition is an unpleasant reality for state revenue and budget officials, but it is an effective restraint on state and local taxes,” said the report. “It also helps to more efficiently allocate resources because businesses can locate in the states where they receive the services they need at the lowest cost.”

“When a state imposes higher taxes than a neighboring state, businesses will cross the border to some extent. Therefore, states with more competitive tax systems score well in the index because they are best suited to generate economic growth,” said the report.

To see the full report, visit: taxfoundation.org.

So tell me again…why would a growing company with lots of jobs to fill decide to move into RI? Don’t worry about all our awful rankings for business-friendliness…we have great beaches and italian food! Sure.