Fiscal brinksmanship in Washington and the halting economic recovery in Rhode Island frustrated local business leaders in 2012, but their plans for the year ahead reveal a latent current of optimism running through the region.

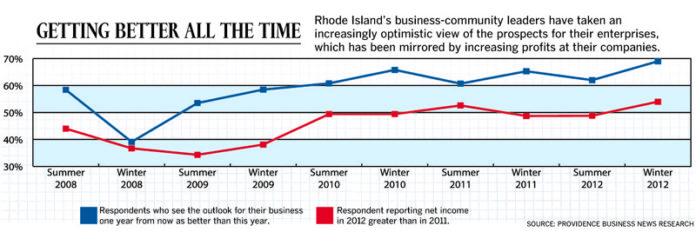

Never in the five-year history of the Providence Business News semiannual business survey have so many respondents had a positive outlook for the year ahead, plans to hire new workers or expand their facilities as they did at the end of 2012.

Their optimism is closely guarded: exasperation with Rhode Island’s progress compared to neighboring states is widespread and a lack of confidence in Ocean State economic policy is palpable.

Nevertheless, judging by their actions in 2012 and intentions for 2013, business leaders here expect economic conditions to continue their slow, upward trajectory in the near future, even if there is another Washington or Smith Hill debacle on the horizon.

“2012 was solid for us,” said Philip B. Barr, CEO of Trans-Tex LLC, in Cranston, which designs and prints color graphics on narrow-web fabric. “We had 12 percent sales growth and moved from Providence, where we were renting, into a new facility in Cranston that we bought and renovated. … We are pretty confident we are going to hold our own and that was enough to give us confidence to move into our own space.”

As in previous years, companies in the software and information technology sectors continued to grow in 2012 and seemed to carry the brightest outlook into 2013.

“I think everything is trending in a positive direction,” said Martin John King, founder and CEO of Gurnet Consulting, an information technology services provider in East Providence. “A fourth-quarter uptick in activity has really accelerated coming into 2013.”

As 2012 wound down, Gov. Lincoln D. Chafee highlighted better-than-expected state revenue collections and some long-overdue improvement in employment figures as evidence his economic plan was working.

And in the 2012 survey results, state leaders will see further encouragement in the 33 percent of respondents who said their companies had increased employment in the previous quarter, compared with 31 percent over the summer and 25 percent last winter.

Perhaps even more encouraging, 45 percent said their companies planned to hire new employees in the next quarter, up from 43 percent last winter and 31 percent over the summer.

In what could be a good sign for commercial real estate and construction, 16 percent of companies surveyed said they planned to expand their facilities in the next quarter, the highest share in the survey’s history and better than the 11 percent last summer and last winter.

Another reason for optimism was that 54 percent of those surveyed said their net income in 2012 exceeded what they made in 2011, marking a steady, upward climb from the low point in the summer of 2009, when only 34 percent reported higher income, to 48 percent last winter and summer.

Still, Mazze attributed much of the brightening outlook of Rhode Island and southeastern Massachusetts executives to a rising national economy more than local conditions.

He pointed out that while 69 percent of businesses surveyed said they expected their own 2013 to be better than 2012 ahead – the highest share in survey history – only 46 percent said the same thing about the broader Rhode Island economy.

Although better than the bleak winter of 2008, when only 18 percent thought Rhode Island would see a brighter tomorrow, the 46 percent predicting Ocean State economic improvement was smaller than at the same time last year, when it was 48 percent.

For that, Mazze blamed a lack of direction in Rhode Island state government, where persistently low business-climate rankings have not brought major policy changes.

“Businesspeople continue to shout and scream that we need to do things to make it easier to do business, and the executive and legislative branches have just not responded,” Mazze said. “Bureaucracy, health care, taxes, all of these things are said over and over again.”

Of the challenges business leaders blame for slowing growth, taxes and fees continue to feature prominently.

Bogh AV Productions Executive Producer Richard Boghosian said his Warwick video-production business performed steadily all through the recession, but he remains a one-person outfit partly because of the added cost of hiring caused by unemployment benefits.

Over the years, Bogh AV twice had full-time employees, but after letting them go and seeing them collect 99 weeks of unemployment, Boghosian said he would now have to pay the highest unemployment-insurance rate, about 10 percent, for any new hire. That, added to the cost of workers’ compensation, makes bringing on full-time employees prohibitive, he said.

Still, even though he doesn’t plan to hire anyone new, Boghosian expects to do well in 2013.

At Providence information technology service provider Logicomm Inc., partner Jim Van sees the move toward contract work and away from a large, full-time workforce continuing, along with more professionals breaking out on their own or in small groups spun off from larger operations.

“We are focusing on smaller clients than we used to when we started doing IT support for small business in 2004 – the average size of the companies goes down while the number of them goes up,” Van said. “We are seeing accidental entrepreneurs who were laid off with a good severance use it to get something going. They work out of virtual offices and do meetings at restaurants instead of conference rooms.”

Logicomm has five full-time employees and approximately 25 contractors who the company hires on a contingency basis when a project ramps up or a customer needs help. Van hopes to hire one more full-time employee in 2013 and another three field technicians as contractors.

Although his business is computers, Van said one thing he would like to see economic-development leaders in Rhode Island and Massachusetts focus on is helping small businesses, entrepreneurs and freelancers outside of the high- technology fields grow.

“There is lack of support for the independent worker and freelancer,” Van said. “Everyone goes after the low-hanging fruit, the great, young college people and tech people. Who is doing any kind of support for the next Cardi’s Furniture or a good plumber?”

“There are still not a lot of traditional jobs out there, but there is a lot of work,” Van added. “Give people the assistance they need to go out and earn on their own or through contracting.”

While most of the survey results pointed in a promising direction, there were some exceptions.

Four percent of respondent said they planned to close at least some of their facilities in the next quarter, up from 1 percent last winter.

And potentially offsetting those looking to hire new workers, 7 percent of companies surveyed said they expected to lay off employees during the next quarter, up from 3 percent over the summer and last winter. In the winter of 2008, 12 percent of companies responding to the survey said they expected to lay off workers during the next quarter.

Possibly reflecting a slowdown caused by the fiscal-cliff impasse at the end of 2012, only 46 percent of those surveyed said their business activity in the current quarter had been better than the previous quarter, down from 50 percent in midsummer and 54 percent last winter.

Fifty-four percent said the cost of materials and supplies had risen over the previous quarter, down from 55 percent over the summer and 56 percent last winter.

Looking ahead, 19 percent of respondents planned to raise prices in the next quarter, up from 9 percent last winter, likely anticipating higher demand.

Perhaps the market that best typified the slow, steady improvement of 2012 was real estate, where sales volume has been creeping up for more than a year, and prices are now just starting to perk up as well.

David Enstone, principal of William Raveis Real Estate in Newport, quoted Winston Churchill’s famous “this is not the end … not even the beginning of the end” line to describe the recovery in the Rhode Island housing market.

“This is the end of the beginning,” Enstone said. “2012 was probably the end of the real estate recession in Rhode Island. The market has started to swing back to being biased for the buyer, to a balanced market.”

But Enstone said as conditions improve, he sees a widening gap between conditions in the southern half of the state and northern half.

“Newport County has become extremely active, but the further north you go in the state, the recovery is delayed,” Enstone said.

As for whether the recovery would encourage real estate companies to recruit more Realtors, Enstone said some might, but in the case of Raveis, the focus would still be on making the existing sales associates as productive as possible.

Since the start of the recession, early-year optimism has sprouted several times only to be extinguished a few months later by setbacks, such as a eurozone crisis, municipal crisis, foreclosure spike or congressional meltdown.

As 2013 gets going, the looming national debt-ceiling fight promises more economic uncertainty.

At Gencorp Insurance Group in East Greenwich, which added one full-time employee in 2012 and expects to do the same this year, Executive Vice President Joseph Padula said the fragility of the recovery and political uncertainty were leading many companies to be very tentative and conservative.

“I think there is still a lot of hesitation and uncertainty, and it is related to tax issues, the deficit and, in this area in particular, unemployment,” Padula said. “I think businesspeople are still cautious.” •

No posts to display

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.