PROVIDENCE – Activity in the Rhode Island commercial real estate market should continue to rise in 2013, with rents stable and landlord concessions diminishing, CB Richard Ellis-New England executives said in their annual market overview Thursday morning.

With interest rates low and real estate prices in Boston at or above their pre-recession peak, secondary markets like Providence are increasingly attractive to investors, CBRE said in its annual market overview released at the event.

“There has been a rebirth of the capital markets in 2012,” CBRE said. “This trend is a clear indication that investors that only looked at deals in their primary market during the initial recovery state of the latest market cycle are now looking at opportunities in a strategically located secondary market with strong fundamentals. Rhode Island clearly fits the foregoing profile which should mean continued investor activity and interest in 2013.”

But based on last year’s trends, the outlook for 2013 will vary in different segments of the market.

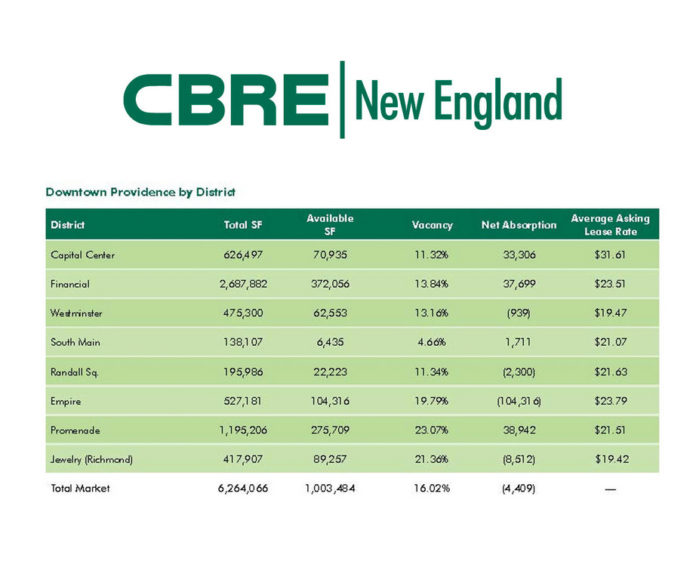

Although downtown Providence office vacancy ticked up slightly in 2012, to 16 percent from 15.9 percent in 2011, Class A vacancy dropped to 8.4 percent, the lowest rate in a decade.

There was a net loss of 122,000-square-feet of Class B office occupancy in 2012, mostly as a result of the 104,000 square-feet of space abandoned by the bankrupt 38 Studios LLC.

The average downtown asking lease rate rose from $22.80 in 2011 to $23.50 last year, the highest rate since 2008.

The Capital Center, Financial District, Promenade and South Main Street neighborhoods all had positive absorption in 2012, while Westminster, Randall Square, Empire and the Jewelry District all had negative absorption.

In the suburban Rhode Island office market, there was 145,789 square feet of year-over-year positive absorption in 2012 and a 20.22 percent vacancy rate, the lowest since 2008.

The Northern Rhode Island office market remained soft, with a 31-percent vacancy rate, while the West Bay and suburban Providence showed the most positive absorption, 141,000 and 59,000 square feet respectively.

In Rhode Island industrial space, the vacancy dropped from 10.4 percent in 2011 to 9.9 percent in 2012.