(Updated 12:46 p.m.)

PROVIDENCE – The cash sales share of total home sales in the Providence-Warwick-Fall River metropolitan area fell to 22.5 percent in November, a percentage point decrease from November 2015, CoreLogic said this week.

Rhode Island’s cash sales share for November was higher at 29.4 percent, and it also rose 2.7 percentage points year over year.

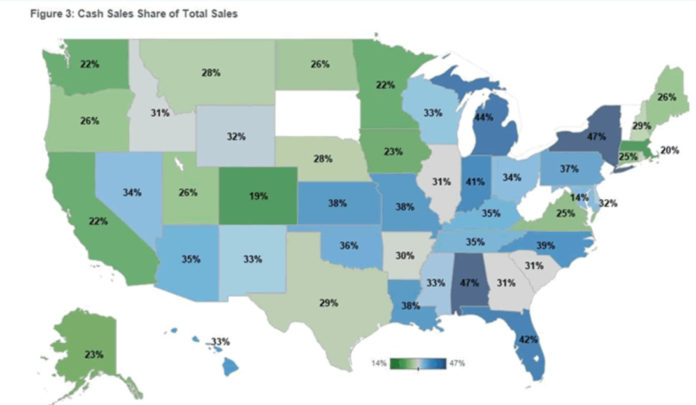

The national rate was higher than the cash sales share for both the Providence metro and Rhode Island at 32.4 percent, CoreLogic said. The national cash sales share rate fell 4.3 percentage points over the year.

The national cash sales share peaked in January 2011, when cash transactions accounted for nearly 47 percent of total home sales. Before the housing crisis, the cash sales share of total home sales averaged approximately 25 percent. If the cash sales share continues to fall at the same rate it did in November, the share should hit 25 percent by mid-2017.

Real estate owned sales had the largest cash sales share nationwide in November at 60.2 percent. Resales had the next highest cash sales share at 32.3 percent, followed by short sales at 31.9 percent and newly constructed homes at 15.5 percent. The percentage of REO sales within the all-cash category remained high, but REO transactions have declined since peaking in January 2011, CoreLogic said.

REO sales made up 4.9 percent and short sales made up 2.6 percent of all distressed sales nationwide in November 2016. The distressed sales share of 7.5 percent in November was the lowest distressed sales share for any month since September 2007. At its peak in January 2009, distressed sales totaled 32.4 percent of all sales, with REO sales representing 27.9 percent of that share. Pre-crisis, the share of distressed sales was approximately 2 percent. If the current year-over-year decrease in the distressed sales share continues, it will reach 2 percent by the year’s end, CoreLogic estimates.

All but eight states recorded lower distressed sales shares in November 2016 compared with a year earlier. Maryland had the largest share of distressed sales of any state at 18.4 percent in November, followed by Connecticut (18.2 percent) and New Jersey (15.8 percent). North Dakota had the smallest distressed sales share at 1.4 percent.

New York had the largest cash sales share of any state at 47.4 percent in November.