PROVIDENCE – Local 1 percent hotel, meal and beverage tax collections, as well as state 5 percent hotel tax collections, all increased on a year-over-year, and fiscal year-to-date basis through October, according to the state Department of Revenue.

The local 1 percent hotel tax is collected on the rental of rooms in the state and is remitted, in its entirety, to the municipality in which the room rental was located.

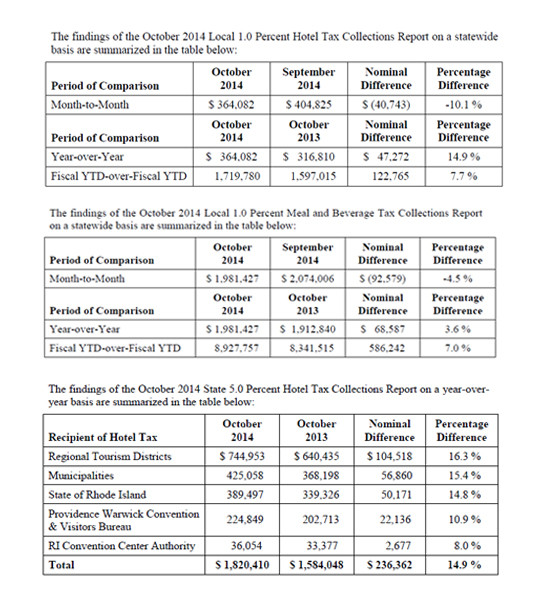

The report showed that $364,082 was collected in October, a 14.9 percent increase over October 2013’s $316,810. When comparing fiscal year-to-date, collections grew 7.7 percent, to $1.7 million. Comparing October with September, hotel tax collections dropped 10.1 percent to $364,082.

“The decline in local hotel tax collections between October and September was less than what was recorded last fiscal year for this period when the inter-month decline was 17.3 percent. The year-over-year growth of 14.9 percent for October 2014 appears to be due to delays in the payment of hotel taxes and the recording of these revenues in the proper month,” Director of Revenue Rosemary Booth Gallogly said in a statement.

Like the local 1 percent hotel tax, the local 1 percent meal and beverage tax collections are remitted in full to the municipalities in which they were consumed.

Year-over-year, $2 million was collected in meal and beverage taxes, an increase of 3.6 percent, while fiscal year-to-date, $8.9 million was collected, a 7 percent increase. Month-to-month, meal and beverage tax collections dropped 4.5 percent.

“Local meal and beverage tax collections slipped slightly in October as compared to September as is normally the case this time of year,” Gallogly said.

The fiscal 2015 state 5 percent hotel tax collections report for October showed a 14.9 percent increase year-over-year, to $1.8 million. This tax is collected on the rental of rooms in the state and is distributed based on a formula outlined in the R.I. general laws.

Of the $1.8 million total, regional tourism districts received $744,953, a 16.3 percent increase over the prior-year period, while municipalities received $425,058, a 15.4 percent increase; the state of Rhode Island, $389,497, a 14.8 percent increase; Providence Warwick Convention and Visitors Bureau, $224,849, a 10.9 percent increase; and R.I. Convention Center Authority, $36,054, an 8 percent increase.

Said Gallogly, “State hotel tax collections continued its positive growth on a year-over-year basis in October. Although year-over-year growth was positive for October 2014 and the rate of growth was significantly more than for the same period last year, anomalies in the payment of hotel taxes makes it difficult to have a meaningful comparison.”

Fiscal year-to-date, 5 percent hotel tax collections grew 7.7 percent, to $8.6 million, with regional tourism districts and municipalities receiving the largest shares and increases, at $3.6 million and 8 percent, and $2.1 million and 8.4 percent, respectively.