PROVIDENCE – Five percent hotel tax collections increased over the year by nearly 6 percent in October, and jumped almost 13 percent when comparing the first four months of the fiscal year with the same period last year, the state Department of Revenue reported this week.

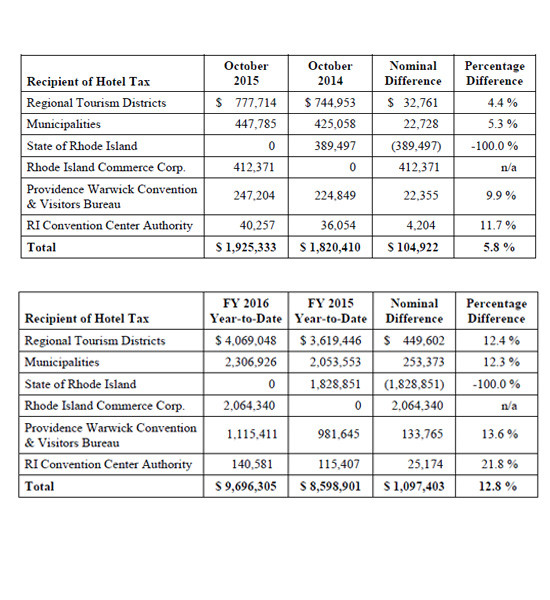

The 5 percent hotel tax climbed to $1.9 million in October from $1.8 million in October 2014. For the first four months of the fiscal year, hotel tax collections rose to $9.7 million compared with $8.6 million last year, the state agency said.

The tax, collected on the rental of rooms in the state, is distributed according to a formula to regional tourism districts, municipalities, the R.I. Commerce Corporation, Providence Warwick Convention & Visitors Bureau and R.I. Convention Center Authority.

Acting Director of Revenue Marilyn S. McConaghy said that state hotel tax revenue posted “modest growth” year over year in October, providing $412,371 for Commerce R.I., money which she said will be used to create a state-level tourism promotion campaign, a high priority of Gov. Gina M. Raimondo. She added that the Omni Providence Hotel showed “strong growth” in room rentals in October as state hotel taxes attributable to that hotel rose by nearly 12 percent year over year, its second consecutive month of a double-digit year-over-year increase.

McConaghy also was impressed with the growth in collections fiscal year over fiscal year.

“The truly astounding part is that the difference between [fiscal] 2016 and [fiscal] 2015 year-to-date state hotel tax collections has eclipsed $1 million, a metric that wasn’t reached until April in [fiscal] 2015,” she said in a statement.

On a fiscal year-to-date basis, state hotel tax collections provided more than $2 million to Commerce R.I.’s tourism promotion and business attraction campaign, she said.

“The enhanced revenues for tourism promotion and business attraction should pay dividends in future months as visitations increase and out-of-state businesses are made aware of everything Rhode Island,” she said.