Every month PBN publishes the e-forecasting.com/Providence Business News Leading Economic Indicator Index. The index, compiled by combining a number of economic measures, including building permits, consumer expectations, exports of manufactures, cumulative interest rate spread, national orders index, state employment barometer, national stock prices, unemployment claims and weekly hours in manufacturing, is designed to be predictive of peaks and troughs of the business cycle in Rhode Island.

For instance, last week, the May LEI stood at 131.6, a number that shows the state has experienced overall economic growth compared with the baseline 100 reading in 2000.

That number, however, was an increase of 0.2 percent from the LEI in April, which itself saw a 0.1 percent increase from the March reading.

More important than the monthly changes, however, is the six-month growth rate, which is smoothed and annualized to remove the often volatile nature of month-to-month readings. In theory it is a more accurate predictor of the state’s economic activity, what e-forecasting.com calls “a signal of turning points in the future direction in the business cycle.”

In May the six-month growth rate rose by an annual rate of 1.7 percent, which followed a rate of 1.8 percent in April and 2.1 percent in March. These readings signal that the Rhode Island economy could experience a slowdown in the rest of the year.

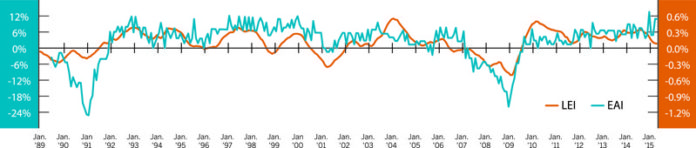

The likelihood of a major downturn would require a larger number than that, but a comparison with the state’s Economic Activity Index, as calculated by the Federal Reserve Bank of Philadelphia, shows that the e-forecasting.com calculations are predictive to a certain degree.

The two indexes, looked at from January 1989 until May have a correlation coefficient of 0.55. Thus, the LEI does, on average, show which direction the Rhode Island economy is heading. And given that, it may not be smooth sailing ahead. •