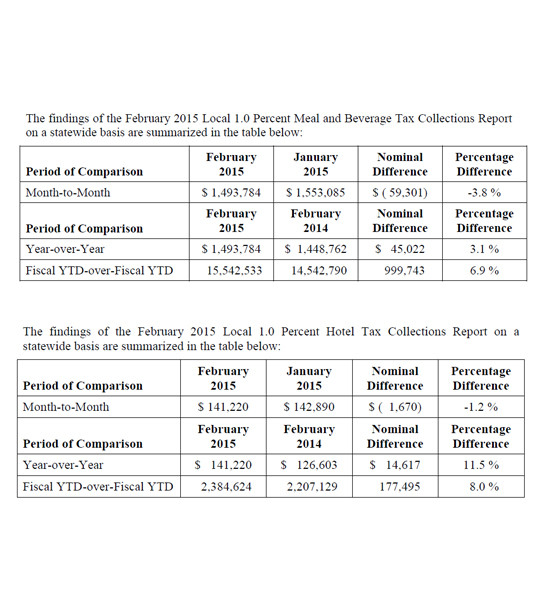

(Updated 1:20 p.m. and 9:20 a.m.) PROVIDENCE – Local 1 percent meal and beverage tax collections rose 3.1 percent year over year in February, and 6.9 percent when comparing fiscal year over fiscal year, the state Department of Revenue reported Monday.

A total of $1.5 million was collected in February, compared with $1.4 million in February 2014. Acting Director of Revenue David M. Sullivan said collections rose modestly, “somewhat surprisingly,” despite the harsh winter weather.

For the first eight months of the fiscal year, $15.5 million was collected, almost $1 million more than the previous fiscal period.

The local 1 percent tax is collected on the sale of a meal and/or beverage that is prepared away from home; the amount of tax collected is remitted, in full, to the municipality in which the meal and/or beverage is consumed, according to the DOR.

The local 1 percent hotel tax collections report showed an 11.5 percent increase year over year in February to $141,220, and an eight percent increase fiscal year over fiscal year to $2.4 million.

Sullivan said in a news release that “growth in [fiscal] 2015 local hotel tax collections accelerated on a year-over-year basis increasing from 3.4 percent in the January report to 11.5 percent in the February report.”

The local 1.0 percent hotel tax is collected on the rental of rooms in the state and, like the meal and beverage tax, remitted, in full, to the municipality in which the room rental was located.

In other news, the DOR also released its fiscal 2015 state 5 percent hotel tax collections report for February, showing a year-over-year increase of 11.5 percent to $706,099. The tax is collected on the rental of rooms in the state and distributed according to a formula.

Of the $706,099, the largest share went to regional tourism districts at $265,738, an 11.3 percent increase from February 2014, while municipalities received $162,110, an 11 percent increase, and the state of Rhode Island, $151,740, an 11.7 percent increase.

The Providence Warwick Convention & Visitors Bureau received $109,213, an 11.7 percent increase, and the R.I. Convention Center Authority, $17,297, an 18.6 percent increase.

On a fiscal year to date basis, 5 percent hotel tax collections grew 8 percent, to $11.9 million, compared with the same fiscal period last year. Regional tourism districts received the largest amount – $4.9 million, representing an 8.1 percent increase.

Said Sullivan, “Growth in fiscal year-to-date state hotel tax collections through February 2015 improved modestly relative to the January 2015 report but remained well above the fiscal year-to-date over fiscal year-to-date growth rate of 5.2 percent that was determined last year at this time.”

Martha Sheridan, president and CEO of the Providence Warwick Convention & Visitors Bureau, noted that the U.S. Figure Skating Association Synchronized Skating Championships came to Rhode Island in February, boosting hotel attendance.

“This group utilized approximately 4,800 hotel room nights in the greater Providence area,” Sheridan said.

Also, she said that the Newport Marriott was closed for renovations all winter “so an increase in spite of that closure is very impressive.”