IRVINE, Calif. – Foreclosures in the Providence-New Bedford-Fall River metro area declined for the month of September compared with the same period last year, and also dropped slightly compared with a month earlier, according to a CoreLogic report released Tuesday.

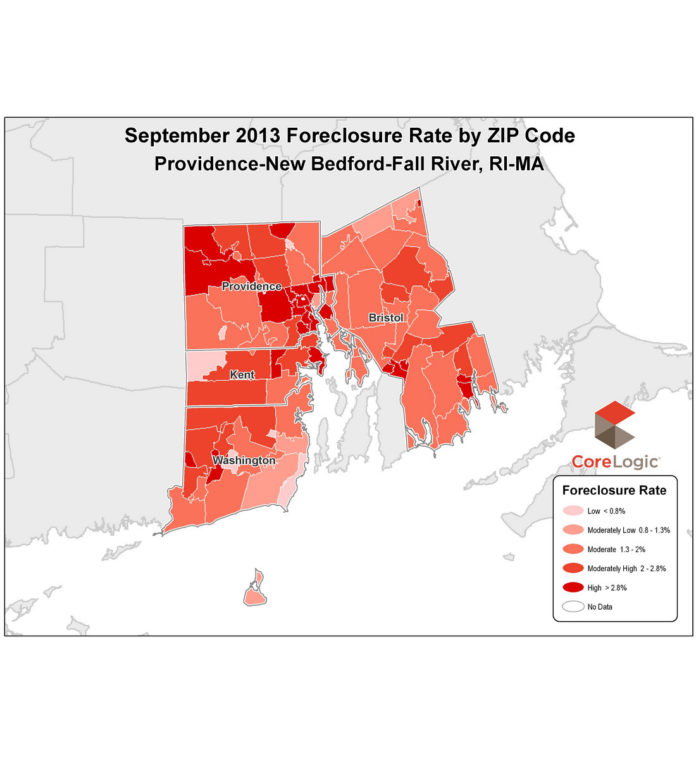

The CoreLogic data reveals that the rate of metro-area foreclosures among outstanding mortgage loans was 2.24 percent in September, a decrease of 0.69 percentage points from September 2012.

In August, the CoreLogic foreclosure rate for the metro area was 2.26 percent.

CoreLogic defines the foreclosure rate as the percentage of home loans in some stage of the foreclosure process, and does not include new foreclosure filings.

Foreclosure activity in Providence-New Bedford-Fall River for September was lower than the national foreclosure rate of 2.29 percent. A year ago, the U.S. foreclosure rate was 3.25 percent.

Statewide, the Rhode Island foreclosure rate reached 2.39 percent in September, down 0.68 percentage points from the September 2012 rate of 3.07 percent.

The mortgage delinquency rate also dropped in the Providence-New Bedford-Fall River metro area. According to CoreLogic report, 6.59 percent of mortgage loans were delinquent 90 days or more in September, compared with 7.37 percent during the same period last year.

The national mortgage delinquency rate was 5.21 percent in September and 6.69 percent a year earlier in September 2012.

In the Ocean State as a whole, mortgage delinquency fell to 6.61 percent in September compared with 7.47 percent in September last year.

CoreLogic, based in Irvine, Calif., is a property information, analytics and services provider in the United States and Australia.

Foreclosures are increasing nowadays. Report says that a drop in the number of foreclosures, indicating a continued healing in the housing market. According to the online real estate marketer, foreclosure filings fell by 7 percent in September, to 180,427. That was 16 percent less than the year before. It was also the lowest level in five years. Source of article: Heart Attack after Foreclosure

Foreclosures are increasing nowadays. Report says that a drop in the number of foreclosures, indicating a continued healing in the housing market. According to the online real estate marketer, foreclosure filings fell by 7 percent in September, to 180,427. That was 16 percent less than the year before. It was also the lowest level in five years. Source of article: http://personalmoneynetwork.com/moneyblog/2012/07/10/heart-attack-after-foreclosure/