Rhode Island ranks among the top five in the country for having mortgages with negative equity, according to a January report from CoreLogic. But the numbers, while accurate, don’t tell the whole story, several Rhode Island real estate brokers say.

Rhode Island was fourth on the list, with 14.8 percent of properties in negative equity in 2014’s third quarter. Only Nevada at 25.4 percent; Florida, at 23.8 percent; and Arizona, at 19 percent, were higher. Illinois was fifth at 14.1 percent.

Bruce Lane, president of the Rhode Island Association of Realtors, says the 14.8 percent, or 34,521 properties, in negative equity need to be viewed in the context of the percentage reported after the housing bubble burst in 2008. CoreLogic did not begin tracking negative equity until 2009. In the third quarter of 2009, negative equity in Rhode Island was at 17.04 percent, and continued to climb through most quarters to more than 22 percent through the third quarter of 2012 before beginning to drop again, said CoreLogic spokeswoman Alyson Austin.

According to Lane, in the third quarter of 2008 short sales and foreclosures alone were 37 percent of all sales. A mortgage holder for a property that is in negative equity or “underwater” owes more than the property is worth – but not all those owners are necessarily being forced to sell in a foreclosure or choosing to sell in a short sale, where the owner has to pay the difference, Lane and other brokers said.

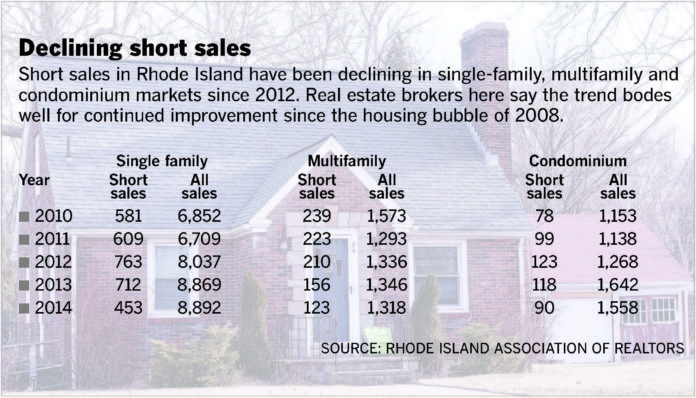

And short sales in Rhode Island have been declining in single-family, multifamily and condominium markets since 2012, according to the Realtors association.

“As long as the percentages of distressed sales [are] shrinking annually, then we’re moving in the right direction,” said Lane, who recently joined Prudential Gammons Realty’s Cranston office as a broker associate.

Sally Lapides, president and CEO of the Providence-based real estate agency Residential Properties, notes that appreciation of home prices has dipped slightly recently, but is more like what it was 30 years ago than the artificial high in 2008.

“Many people who were underwater, if they had the option of holding onto their houses, they saw that the market was getting better and they were more likely to hold onto their houses until they were no longer underwater,” she said. “So, there is a high demand, particularly in Providence but almost any of the higher-end cities and towns, for homes between about $300,000 and $800,000.”

Lapides, who does not handle a lot of short sales, predicts that the spring will bring sellers lured by stronger prices and lower inventory who have wanted to put their homes on the market in past years but couldn’t.

“I see people a little more secure in their jobs while interest rates have stayed incredibly low, so I see some positive, encouraging spirit out there,” she said. “And for me to say that in January … [it] is something I haven’t said in quite a long time.”

Lane owns property in Cranston that is underwater, and empathizes with the plight of people who may not be in the position he is in, where he feels he can wait while home values recover, however gradually, he said.

He bought a single-family Cape at 84 Intervale Road with his son in 2007 for $245,000. The property is now worth only $170,000, and an adjoining lot that he was hoping to build on has been rendered useless because flood zones in the neighborhood have been redrawn, he said. He does have the advantage of being able to rent the house, he noted, though he still owes a balance of $183,000.

“We chose to wait it out,” he said. “Some people might not be able to do that.”

Bob Martin, a broker owner of the Crossroads Real Estate Group in Glocester and Woonsocket and a former Realtors association president, says about one-quarter of his transactions are short sales.

“The trend has been getting better,” he said. “Values have increased, so people have gained equity in the last three years.”

Martin noted, however, that lenders are still moving slowly to approve short sales, and that needs to improve. It sometimes takes as long as a year and a half to get an approval, he said.

“The process is very cumbersome,” he said.

Clark Farley, who handles South County properties for Randall Realtors of Charlestown, said the challenge of negative equity has abated but “hasn’t gone away.

“The rate of decline in depreciation has leveled off,” Farley said. “What I tend to see [is] it’s maybe hinting at getting stronger, but I don’t see significant upward progress yet.” •