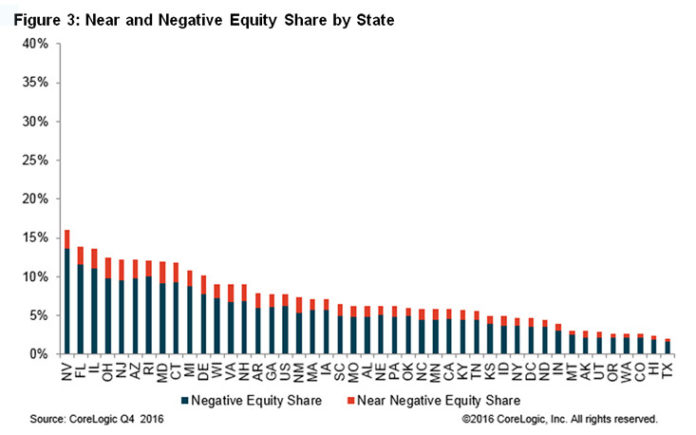

PROVIDENCE – Rhode Island had the fourth-highest percentage of mortgaged homes in negative equity in the fourth quarter at 10 percent, CoreLogic said Thursday.

The Ocean State trailed only Nevada, Florida and Illinois, which had negative equity proportions of 13.6 percent, 11.6 percent and 11.1 percent, respectively.

Rhode Island had 24,043 homes in negative equity out of 241,429 homes with a mortgage.

Negative equity, also referred to as “underwater” or “upside down,” means more money is owed on homes than they are worth. Negative equity can occur because of a decline in home value, an increase in mortgage debt or both, according to CoreLogic.

In the fourth quarter, nearly 9 percent of Providence-Warwick-Fall River metropolitan area mortgages were in negative equity, or 32,442 Providence metro homes.

The percentage of homes in negative equity was higher in both Rhode Island and the Providence metro than nationally in the fourth quarter.

The percentage of homes in negative equity was 6.2 percent nationally in the fourth quarter, a little more than 3 million homes.

Approximately 63 percent of U.S. homeowners saw their equity increase last year by a total of $783 billion, a nearly 12 percent increase. More than 1 million borrowers also moved out of negative equity last year, increasing the percentage of homeowners with positive equity to 93.8 percent of all mortgaged properties, or 48 million homes.

“Average home equity rose by $13,700 for U.S. homeowners during 2016,” Frank Nothaft, chief economist for CoreLogic, said in a statement. “The equity build-up has been supported by home-price growth and paydown of principal. The CoreLogic Home Price Index for the U.S. rose 6.3 percent over the year ending December 2016. Further, about one-fourth of all outstanding mortgages have a term of 20 years or less, which amortize more quickly than 30-year loans and contribute to faster equity accumulation.”

Texas had the highest percentage of homes with positive equity at 98.4 percent.

The Providence metro had an additional 7,441 properties, or 2 percent of properties, in near-negative equity (which is less than 5 percent equity) in the fourth quarter. Rhode Island had 5,147 properties, or 2.1 percent of properties, in near-negative equity.

Nationally, the near-negative equity share again was lower, at 1.6 percent.