Undergraduates at some local schools are turning to financial-literacy programs to help them cope with college debt, which can easily exceed the mortgage of a modest home.

The Rhode Island School of Design, Johnson & Wales University and Brown University all have financial-literacy programs, despite the fact that their default rates differ substantially.

Amanda Silverman, 22, who will graduate in August from JWU with degrees in fashion merchandizing, retail marketing and graphic design, expects to have approximately $40,000 in student-loan debt – even though she works two part-time jobs in addition to going to school.

Silverman has explored the financial-literacy iGrad program, a third-party program JWU offers, to learn about what typical college debt is and how to handle and pay back what one owes. Some scholarship money, part of which comes from working in the university’s communications and media-relations department, helps offset her debt.

The program, which includes budgeting tips and personal fiscal-planning help as well as information about student loans, “has helped me to understand where I fall [compared with peers],” Silverman said. “When you find out how much debt you have, it’s not as bad as it seems, so you feel like you’re not trapped under a mountain of debt you’ll never be able to pay back.”

There are 7,697 registered users of the program across the entire university, with nearly half, 3,709, just in Providence, said Lynn M. Robinson, executive director of student academic and financial services for JWU.

Brown built its program, “Get Your Bearings,” and branded it in 2011.

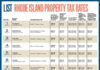

JWU’s default rate in 2010, the most recent year available, was 14.6 percent, said Robinson. Brown’s 2010 default rate was 2 percent, said Keirsten Connors, Brown’s loan-office manager. RISD’s default rate for 2010 was 4.2 percent, said Anthony Gallonio, director of financial aid.

While Rhode Island’s average default rate for its independent colleges and universities is 12.8 percent, nearly 2 percent less than the national average of 14.7 percent, more colleges are looking at adding financial-literacy programs, said Gallonio, Daniel P. Egan, president of the Providence-based Association of Independent Colleges and Universities of Rhode Island, and Charles Kelley, executive director of the R.I. Student Loan Authority.

“We’re seeing more and more colleges adopting some form of financial-literacy program,” Gallonio said.

“We have institutions with strong financial-aid programs,” added Egan. “Our institutions are fiscally sound and have made a strong commitment with the recession to increase their financial-aid packages and numbers and limit the amount of debt students take on.”

RISD not only has its own financial-literacy program, Gallonio said; it has a nearly 20 percent “activation” rate for its students and alums who participate in a program offered by American Student Assistance, a national nonprofit based in Boston that works with students and alumni on default management and debt-management practices.

“If you can educate students and say, ‘Hey, don’t run away from this’ – a lot of it is getting out in front of the students and just educating them,” he said.

The R.I. Student Loan Authority is a nonprofit, quasi-state agency that has been providing affordable higher education loans since 1981. The authority also offers students and parents free educational admissions and financial-aid assistance through the College Planning Center of Rhode Island and financial-literacy guidance at high schools and colleges throughout the state, Kelley said.

Last year, the authority offered 70 financial-literacy seminars to high schools, colleges and community groups across the state, focusing on financial fundamentals, budgeting, credit, identify theft and the like. More than 1,600 college students and some high school students took part, Kelley said.

Bryant University and Providence College do not have financial-literacy programs, but are exploring the possibility of offering them.

“It is something we’re looking to develop,” said Sandra Oliveira, executive director of financial aid at PC.

Even though PC’s default rate is a low 2.2 percent, a financial-literacy program could help reduce that number further, Oliveira said.

“It’s just something that is good service to students,” she said. “It’s not only about the ability to repay student loans; it’s also about the importance of retirement programs like 401(k)s and personal financial management.”

Bryant’s default rate was 3.4 percent in 2010, said spokeswoman Elizabeth O’Neil.

Costs for higher education don’t come cheap. The 2013-14 academic year at PC will cost as much as $57,800 for both direct expenses such as tuition and room and board and indirect expenses, including books and living expenses. At Brown, the total comes to $60,460. The cost at JWU for a new student living on campus amounted to $42,463. After four years, those totals exceed $150,000.

The iGrad, RISD and Get Your Bearings programs have both online and in-person advising components that make educating students about their debt both personal and fun, educators say.

“We had 91 students attend our spring 2013 workshop series,” said Connors, of Brown. “We’ve seen an increase this fall term, with 145 students attending our fall 2013 workshops. We’re also seeing more awareness with the staff [and] faculty, and several have attended our workshops.”

The University of Rhode Island, which doesn’t have a formal financial-literacy program, had a default rate of 6.9 percent in 2010, said university Director of Communications and Marketing Linda Acciardo. URI has a required freshman course called URI 101 that includes a module on personal finance and college costs, and has launched related initiatives, like “15 to Finish in 4,” which focuses on making sure students earn 15 credits a semester to finish in four years, she said.

Amanda Amaral, a 21-year-old senior at URI, and her father, Joseph Amaral, estimate she’ll owe about $30,000 when she graduates, since her father helped pay about $32,000 in her first two years, before the family started experiencing financial difficulties. One bit of help is a financial-literacy course she took through the R.I. Student Loan Authority. Her reward: a waiver of a loan origination fee totaling about $680.

Joseph Amaral said he appreciates the $680 savings, while his daughter felt participating in the course helps her understand her obligations.

“It’s something you worry about, but I work now so I know what paying for bills are like and my dad has always helped me save money from my paychecks, so I’m not overly worried,” she said. “It’s something you have to do when you grow up.” •