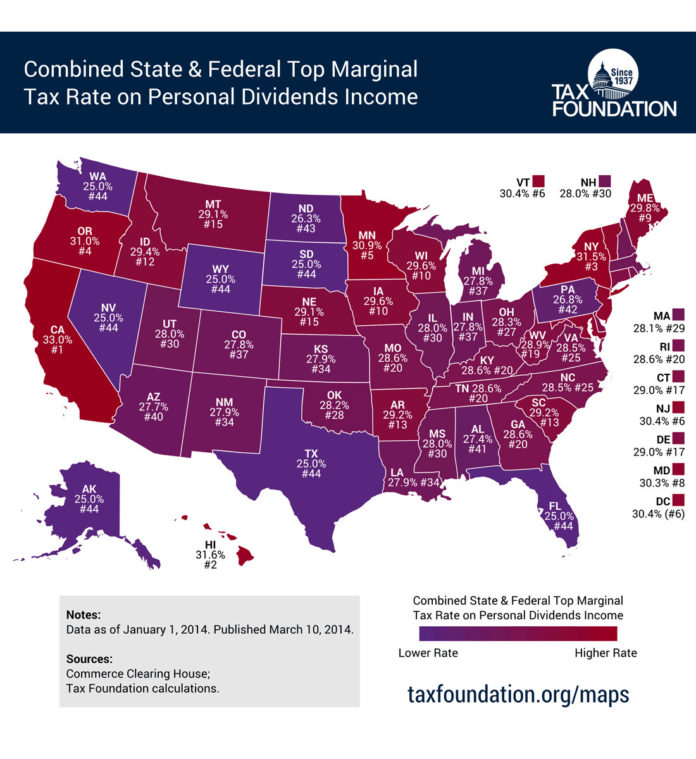

PROVIDENCE – Rhode Island’s combined state and federal top marginal tax rate on personal dividends income, currently 28.6 percent, ranks as the 20th highest rate in the country, according to a study published by the Tax Foundation on Tuesday.

The Tax Foundation calculated the combined marginal tax rate by adding a state’s individual maximum personal dividend income tax (6 percent in Rhode Island) to the federal rate of 23.8 percent, which consists of the 20 percent top marginal tax rate plus a 3.8 percent net investment tax to fund the Affordable Care Act.

The study also accounted for whether a state levies local income taxes or allows a taxpayer to deduct their federal taxes from their state taxable income (which accounts for the Rhode Island rate not being a simple addition of the federal and state top marginal rates).

Rhode Island tied at No. 20 with Georgia, Kentucky, Missouri and Tennessee. All five of those states posted a combined state and federal top marginal tax rate on personal dividends income of 28.6 percent, which was also the national average, according to the Tax Foundation study.

Massachusetts ranked at No. 29 with top marginal tax rate of 28.1 percent, while two New England states – Vermont (No. 6) with 30.4 percent and Maine (No. 9) with 29.8 percent – ranked among the 10 states with the highest rates in the country. Connecticut came in at No. 17 with 29 percent, and New Hampshire placed at No. 30 with 28 percent.

The state that ranked highest in the Tax Foundation study was California, with a combined state and federal personal dividends income tax rate of 33 percent. New York ranked second-highest with 31.5 percent and Hawaii ranked third with 31.6 percent.

Taxpayers in states with no personal income tax – including Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming – face a top marginal tax rate on personal dividend income of 25 percent, the lowest rate in the country.

On the national level, the Tax Foundation study found that the United States average rate of 28.6 percent ranks ninth-highest among the 33 member countries of the Organization for Economic Co-operation and Development.

The Tax Foundation is an independent tax-policy research organization based in Washington, D.C.