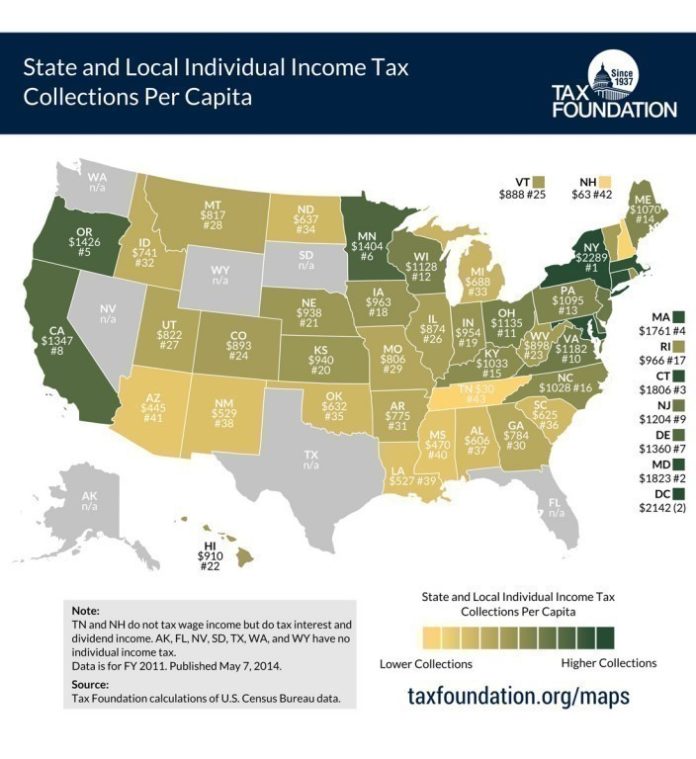

PROVIDENCE – A study conducted by the Tax Foundation found that Rhode Island collected $966 in state and local income tax collections per person in 2011, ranking the state No. 17 in the country for highest per-capita combined collections.

Rhode Island’s 2011 state and local per-capita individual income tax collections came in slightly above the national average of $918 per person. New York collected the most, at $2,289 per person, followed by Maryland with 1,823 per person, Connecticut with $1,806 per person, Massachusetts with $1,761 per person and Oregon with $1,426 per person.

In New England, New Hampshire (No. 42) collected the least of any state regionally, taking in $63 in income tax collections per capita for 2011. Vermont (No. 25) collected $888 per person, and Maine (No. 12) collected $1,070 per person.

The state with the lowest per-capita income tax collections nationwide was Tennessee, with $30 per person. Tennessee and New Hampshire are the only two states in the U.S. that levy a tax solely on investment income and do not have broad-based income taxes.

Among states with broad-based income taxes, Arizona took in the least in 2011, with $445 per person, followed by Mississippi with $470 per person, Louisiana with $527 per person and New Mexico with $529 per person.

Seven states – Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming – levy no state or local individual income taxes and were not included in the Tax Foundation rankings.