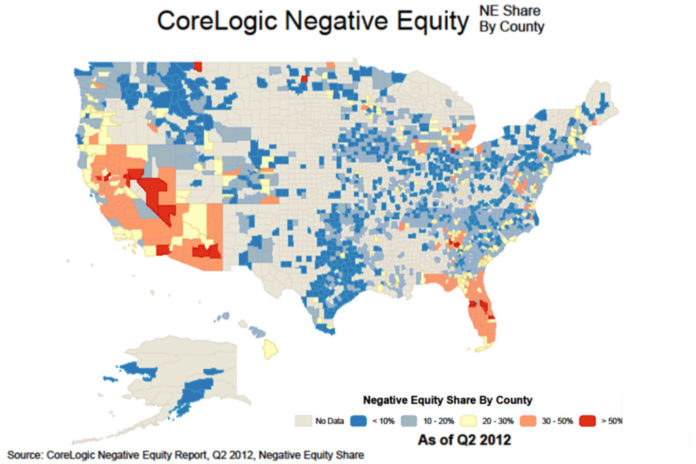

HERE. / COURTESY CORELOGIC" title="THE NUMBER OF RHODE ISLANDERS with underwater mortgages dropped 2.8 percent during the second quarter of 2012. For a larger version of this map, click HERE. / COURTESY CORELOGIC"/>

HERE. / COURTESY CORELOGIC" title="THE NUMBER OF RHODE ISLANDERS with underwater mortgages dropped 2.8 percent during the second quarter of 2012. For a larger version of this map, click HERE. / COURTESY CORELOGIC"/>PROVIDENCE – The number of underwater homes in Rhode Island dropped 2.8 percent in the second quarter.

There were 51,727 properties in the Ocean State worth less than the outstanding mortgages on them in the April-June period of 2012, according to the Santa Ana, Calif.-based real estate data firm, down from 53,208 in the first three months of the year.

That dropped the state’s rate of underwater mortgages to 22.6 percent, down from 23.3 percent in the first quarter.

In addition to the underwater homes, 8,527 Rhode Island properties have near-negative equity, with values within 5 percent of their outstanding loan balances.

The Ocean State had $60.5 billion in total residential property in the first quarter and $39.6 billion in outstanding mortgage debt, for a loan-to-value ratio of 65.6 percent.

Massachusetts had 231.826 underwater properties in the second quarter, 15.6 percent, and a loan-to-value ratio of 61.5 percent.

“The level of negative equity continues to improve, with more than 1.3 million households regaining a positive equity position since the beginning of the year,” Mark Fleming, chief economist for CoreLogic, said in a statement. “Surging home prices this spring and summer, lower levels of inventory, and declining REO sale shares are all contributing to the nascent housing recovery and declining negative equity.”

Nationwide, there were 10.8 million homes underwater in the second quarter, or 22.3 percent, down from 11.4 million, or 23.7 percent, in the first three months of the year.

“Nearly 2 million more borrowers in negative equity would be above water if house prices nationally increased by 5 percent,” Anand Nallathambi, president and CEO of CoreLogic, said in prepared remarks. “We currently expect home prices to continue to trend up in August. Were this trend to be sustained, we could see significant reductions in the number of borrowers in negative equity by next year.”