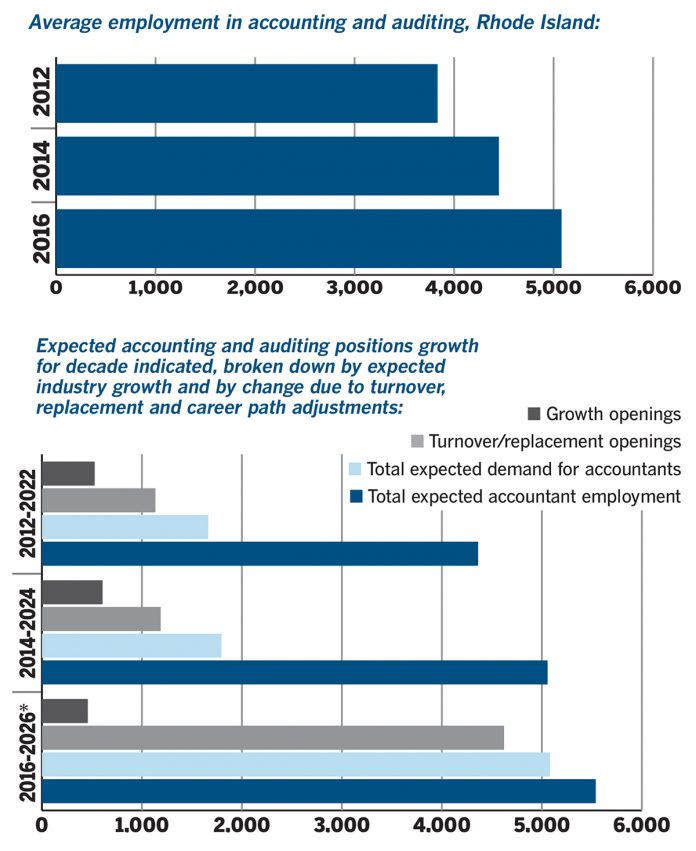

Job-prediction reports published by the R.I. Department of Labor and Training consistently reflect an increasing call for accountants in the state.

In October, the state agency calculated its 2016-2026 occupation-projections report for the statewide workforce, broken down by industry. The latest data shows that accounting and auditing employment is expected to grow by 459 positions in that time, to 5,539.

Similar projections, corroborating a longtime local call for accountants and auditors, have been calculated by the DLT.

In 2014, the DLT published its 2012-2022 job-predictions report that calculated average accountant and auditor employment at 3,834. At that point, the number of accountants employed in Rhode Island within the decade, per the state agency, was expected to rise to 4,362.

Robert A. Mancini, president of the Rhode Island Society of CPAs, said the talent pool in the local industry remains “static … not really growing” which has resulted in a “pretty fierce” hiring atmosphere, not only for new openings but normal turnover due to retirements and the like.

In July 2017, the DLT’s 2014-2024 industry occupational projection report tallied average employment of accountants and auditors at 4,450. By 2024, the number of predicted openings had leaped to 1,795. Among those openings were 607 posts created by the growth of the industry and 1,188 born from turnover and replacement.

The statewide trend is backed up by evidence from a 2017 American Institute of CPAs report that tracks nationwide enrollment in accounting degrees of all levels. The latest data found that, between the 2001-2002 and 2015-2016 academic years, the number of accounting bachelor’s degree enrollees has steadily climbed from 133,435 to 216,482.

Rhode Island’s colleges and universities are working to address the need.

Of the state’s 11 higher education institutions, nine offer graduate and undergraduate accounting programs. Additionally, the New England Institute of Technology offers a business-management associate degree that includes accounting coursework.

Accountancy professor Christine Earley, who has worked at Providence College’s School of Business for the past decade, has witnessed “an increase in the number of students [pursuing degrees in her department].”

Earley’s tenure at the Providence-based school includes the years following the Great Recession, which she feels fueled the growing trend of students seeking accounting degrees as early as 2012.

In her mind, the uptick in students enrolling in the accounting major and related courses were linked to the “financial crisis” sweeping the nation.

‘Students … saw [accounting] as a more steady career choice.’

CHRISTINE EARLEY, Providence College accountancy professor

“Students interested in the financial-services sector saw [accounting] as a more steady career choice” and altered their academic and career plans accordingly, she added. Department enrollment, said Earley, “peaked at 2012 or 2013” and has held “pretty steady” for the past five years.

Not only has this trend increased interest in the accountancy department at PC, it has also necessitated hiring additional professors. Per PC’s count, between 2008 and 2018 there has been a 50 percent increase in full-time accountancy department faculty, from 10 to 15.

Core accounting research faculty at the Mario J. Gabelli School of Business at Roger Williams University has held steady at four “over the past few years,” per the school’s count. But, similar to Providence College, practitioner faculty at RWU – industry experts who take time to teach the next generation of accountants the rigors of trade – has grown.

From fall 2014 to fall 2018, RWU’s two accounting practitioners grew to five.

Susan McTiernan, dean of the Mario J. Gabelli School of Business at RWU, said a “shortage” of accounting graduates has plagued the industry for “many years.” For her, the DLT data is “not a surprise.”

Bryant University has also added full-time professors to its accounting department – going from 14 to 16 over the past 10 years.

While interest in accounting studies has remained “stable,” said Daniel Ames, associate dean of Bryant’s College of Business, the Smithfield-based school launched a managerial accounting and finance degree this year to meet student and industry demand.

The program encompasses preparation for the Certified Management Accountant test, the Certified Information Systems Auditor exam and Bloomberg certification. Ames said the curriculum is reflective of the vast array of “potential career outcomes” for accounting students.

Emily Gowdey-Backus is a staff writer for PBN. You can follow her on Twitter @FlashGowdey or contact her via email, Gowdey-backus@PBN.com.