PROVIDENCE – Rhode Island’s credit unions will train their employees how to spot and respond to cases of “financial abuse” of senior citizens, under a program involving Rhode Island Lt. Gov. Daniel J. McKee.

The initiative also includes an online education program for the public – primarily created for seniors and their loved ones and caregivers – to prevent financial scams and fraud targeting the elderly

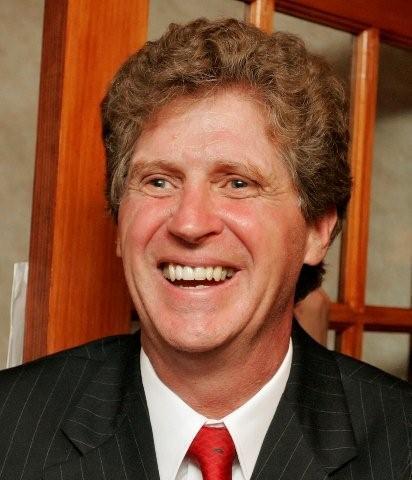

McKee, chairman of Rhode Island’s Long-Term Care Coordinating Council, recently joined representatives of credit unions and Johnston Mayor Joseph M. Polisena for a news conference about the program at the Johnston Senior Center.

The program, dubbed CU [short for Credit Union] Senior Safeguard, was created by the Cooperative Credit Union Association, or CCUA, in response to a national credit union survey in which more than two-thirds of caregivers reported that elderly relatives were once a target of financial scam or fraud.

The credit unions not only hope to raise awareness of the problem, but also to provide resources and financial education to combat it, the group said.

“By sounding the alarm on this growing travesty perpetrated against seniors and by making CU Senior Safeguard available to all people of Rhode Island,” said CCUA President and CEO Paul Gentile, “credit unions hope to lead the way in our efforts to protect seniors and their life savings from loss, abuse, and scams.”

Those interested in learning how to prevent senior financial abuse can visit the website BetterValuesBetterBanking.com.

“Elder financial abuse is an invisible epidemic impacting thousands of Rhode Islanders and seniors across the country,” McKee said. “Unfortunately, because of the sensitive nature of this crisis, many cases go unreported and unresolved.”

Scott Blake is a PBN staff writer. Email him at Blake@PBN.com.