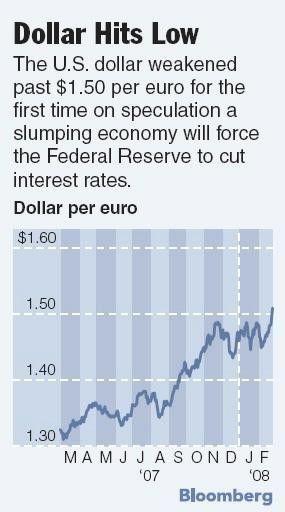

NEW YORK – The dollar fell below $1.51 per euro in New York trading for the first time since the European currency debuted in 1999, after Federal Reserve Chairman Ben S. Bernanke hinted the central bank may lower interest rates again to strengthen the floundering U.S. economy, Bloomberg News said. “This is a new chapter for the dollar,” said Russell LaScala, head of foreign-exchange trading in North America at Deutsche Bank AG in New York. “You are seeing divergence of central banks’ views.”

The Fed “will act in a timely manner” to guard against “downside risks” to the economy, Bernanke told the House Financial Services Committee today in Washington, D.C. In Bonn, Germany, however, European Central Bank policymaker Axel Weber was warning that further cuts are not on the ECB agenda. “The consensus expectation for interest rates on the market at the moment clearly underestimates, in my opinion, the inflation risks,” Weber said.

At 4:32 p.m., the dollar was trading at $1.5118 per euro at 4:32 p.m., after falling as low as $1.5144 per euro earlier in the day; it closed yesterday at $1.4974. It fell to 106.50 yen, from yesterday’s 160.98 yen, but remained about 1 percent above last month’s two-and-a-half-year-low. The U.S. currency hit an all-time low against the Swiss franc and a 23-year low against the Australian and New Zealand dollars.

The U.S. Dollar Index traded on ICE Futures in New York, which tracks the dollar’s value against six major counterparts, fell to its lowest level since the measure debuted 35 years ago, Bloomberg said. The dollar’s decline was “slightly quicker than we thought,” said Derek Halpenny, a senior currency strategist with Bank of Tokyo-Mitsubishi in London. “A lot of hedge fund players have missed this move.”

At its last regular meeting, in January, the Federal Reserve System’s policymaking Federal Open Market Committee pared both the benchmark federal funds rate and the discount rate, shaving 50 basis points from each. (READ MORE>.)

Additional information on the Federal Reserve System, including past monetary policy statements issued by the Federal Open Market Committee, can be found at (www.federalreserve.gov.