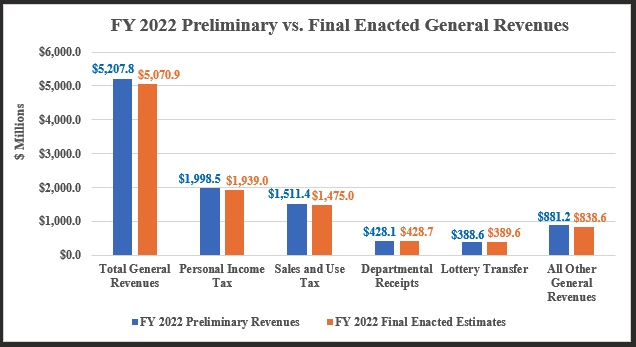

PROVIDENCE – The state’s budget surplus continues to grow, with $137 million more in tax collections than was originally estimated in the revised fiscal 2022 budget, according to the FY 2022 Special Report on Preliminary Revenues released by the R.I. Department of Revenue Oct. 4.

The report compares the fiscal 2022 preliminary revenue as provided in the Controller’s Preliminary General Fund Revenue Report to both the final enacted fiscal 2022 revenue estimates and the audited fiscal 2021 revenue.

How this latest surplus is spent is up to the governor and General Assembly, said R.I. Department of Revenue spokesperson Paul Grimaldi. The fiscal 2023 budget includes a host of tax-relief programs afforded with the benefit of an estimated $900 million surplus, including the $250 child tax credits being issued by the state this week. The governor’s office has estimated the total cost for the latter at approximately $40 million.

Mike DiBiase, president and CEO of the Rhode Island Public Expenditure Council, says the governor and General Assembly could now have over $400 million in extra revenue to work with this fiscal year.

“While it is still early, after two months, state general revenues in the current fiscal year are running 6% ahead of estimates,” DiBiase said. “If this trend continues, there could close to $300 million in extra revenues in the current fiscal year. Adding the $137 million in extra revenues from last year, the governor and General Assembly could have over $400 million in extra revenues to work with on a general revenue budget of around $5 billion. Of course, an economic downturn could alter this scenario.”

in May, RIPEC reported fiscal 2023 estimated revenue was likely overly conservative, based in part on fiscal year revenue running higher by $70M after only one month.

In its Oct. 4 report, DOR found personal income tax collections exceeded estimates by $59.5 million. The report noted almost two-thirds of this variance was due to a lower amount of total refunds issued and higher net accrual.

Business corporations tax revenue grew 13.1% higher than expected to $288.5 million, despite a fiscal 2022 enacted estimate that represented the highest-ever business corporations tax estimate at $255.1 million.

Sales and use tax exceeded enacted revenue by $36.4 million, or 2.5%.

Miscellaneous revenue was $7.8 million less than enacted revenues due to shifting $5.9 million of bond refunding proceeds from fiscal 2022 to fiscal 2023.

The report also stated that preliminary fiscal 2022 total general revenue grew by $776.3 million, or 17.5%, compared with audited fiscal 2021 revenue.

Personal income tax revenue grew 23.7% in fiscal 2022 compared with fiscal 2021, according to the report. Sales and use tax grew 12.7% in fiscal 2022 compared with fiscal 2021, as consumer spending, especially on goods, remained elevated.

Business corporations tax revenue increased by 42.6% in fiscal 2022 compared with fiscal 2021, driven by stronger estimated and final payments, according to the report. Lottery revenue increased by 28.8% after a year of largely normal casino operations.

The report also found revenue from insurance companies increased 21.5% in fiscal 2022 compared with fiscal 2021, which was equally spread between health and nonhealth insurance companies.

Cigarette revenue declined by 6.2% in fiscal 2022 compared with fiscal 2021, following an increase of 16.1% in fiscal 2021 compared with fiscal 2020. The report said the strong collections were likely due to a ban of menthol cigarettes in Massachusetts.