PROVIDENCE – While financial institutions recovered somewhat from the initial blow dealt by COVID-19, year-end profits were still down compared with the year before, according to the Federal Deposit Insurance Corp.

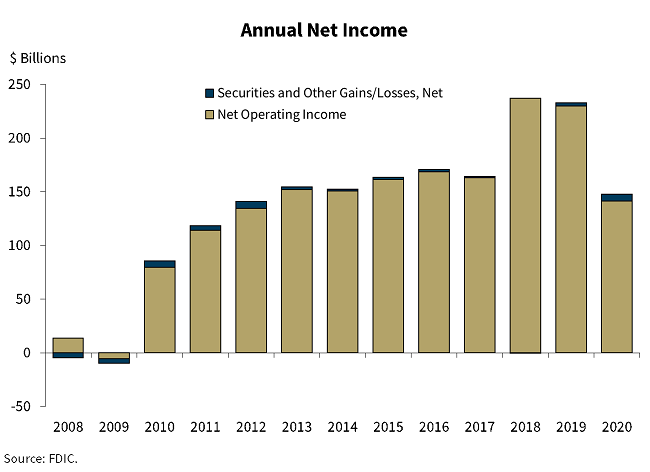

The FDIC’s latest quarterly banking profile published on Feb. 23 showed that across the country, federal deposit institutions saw their 2020 net income slashed by 36.5% compared with the end of 2019. The $147.9 billion in year-end net income was the lowest reported since 2011, according to the FDIC.

Rhode Island institutions fared similarly, with a year-over-year profit decrease of 39.4%, according to FDIC state-level data.

The loss of profits was driven by attempts to shore up credit reserves, with many institutions increasing their provisions for credit losses more than tenfold in anticipation of bad loans due to the pandemic. Despite this proactive protection, most institutions have not seen severe fallout, with a single basis point decline in the net charge-offs compared to loans and leases, from 0.52 on Dec. 31, 2019, to 0.51 as of Dec. 31, 2020. In Rhode Island, the same ratio increased by 15 basis points from 0.35 to 0.50.

Year-end losses were also partially offset by improved performance in the fourth quarter, with the industry nationwide reporting a 9.1% bump in quarterly profits for 2020 compared with the same time frame a year ago, the first uptick after three consecutive quarters of declining revenue. This reflected a drop in the provision expenses set aside in the final quarter of the year due to an improved economic outlook, according to the FDIC.

Banks continued to see their share of deposits grow, with the national deposit share hitting $17.8 trillion, a 22.6% increase over a year ago. The quarter-over-quarter rise in deposits, up $707 billion, is the third-largest increase ever reported in the quarterly banking profiles, according to the FDIC.

In Rhode Island, total deposits reached $160.8 billion as of Dec. 31, compared with $135.4 billion a year ago. This does not reflect deposits from institutions not based in Rhode Island but that may have a share of market deposits in the state.

In a statement, FDIC Chairman Jelena McWilliams highlighted the continued low interest rate environment and economic uncertainties as challenges for the industry that will place “downward pressure” on revenue and net interest margins, but noted strong capital and liquidity levels as mitigation against potential future losses.

Nancy Lavin is a staff writer for the PBN. Contact her at Lavin@PBN.com.