here. / " title="REALTYTRAC said foreclosures and default notices in the Providence metro area fell in 2010 but auction notices rose. For a larger version click here. /"/>

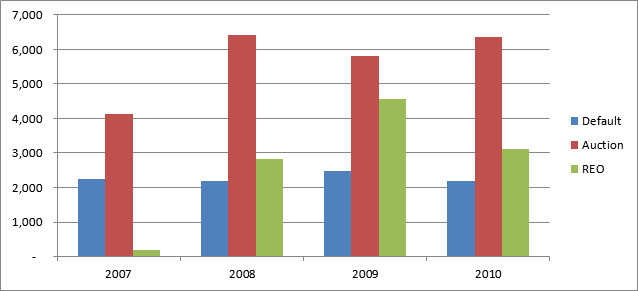

here. / " title="REALTYTRAC said foreclosures and default notices in the Providence metro area fell in 2010 but auction notices rose. For a larger version click here. /"/>PROVIDENCE – The number of foreclosed homes in the Providence metropolitan area dropped in 2010 compared with the previous year, RealtyTrac said Thursday. But in what could be a sign of more foreclosures to come, the number of homes lenders formally advertised for auction increased.

RealtyTrac said lenders repossessed 3,125 homes in the metro area during 2010, down from 4,566 the year before. The number of default notices also dropped to 2,195 from 2,487. But lenders sent more foreclosure auction notices, posting 6,362, up from 5,811 last year.

Across the Providence metro area – which also includes Fall River and New Bedford – RealtyTrac said foreclosure filings touched 8,811 properties or 1 in every 77 homes. (The number of properties receiving notices does not equal the number of filings because some properties receive multiple filings as the foreclosure process progresses.)

Out of the 206 metro areas surveyed by RealtyTrac, 127 had a higher percentage of properties receiving notices than the Providence area. Across the nation, RealtyTrac said some 2.9 million homes – or 1 in every 45 – received a foreclosure notice. The overall number of properties was up 1.7 percent from 2009 and 23.2 percent from 2008 when the real estate market crashed in the fall.

“Foreclosure floodwaters receded somewhat in 2010 in the nation’s hardest-hit housing markets,” said James J. Saccacio, CEO of RealtyTrac. “Even so, foreclosure levels remained five to 10 times higher than historic norms in most of those hard-hit markets, where deep faultlines of risk remain and could potentially trigger more waves of foreclosure activity in 2011 and beyond.”

Saccacio blamed high unemployment last year for driving up foreclosure activity in 72 percent of the nation’s metro areas, including those in areas that had initially escaped a foreclosure wave.