CLICK HERE. / " title="MOODY'S INVESTOR SERVICE said on Monday that Gov. Lincoln D. Chafee's proposed MAST fund would be a positive. For a larger version of this image, CLICK HERE. /"/>

CLICK HERE. / " title="MOODY'S INVESTOR SERVICE said on Monday that Gov. Lincoln D. Chafee's proposed MAST fund would be a positive. For a larger version of this image, CLICK HERE. /"/>BOSTON – Moody’s Investor Service on Monday that Gov. Lincoln D. Chafee’s proposed Municipal Accountability Stability Transparency Fund would be a positive for the underfunded local pensions and OPEB liabilities.

Chafee presented his fiscal 2012 budget on March 8 outlining significant changes to municipal pension funding practices to address the growing $1.9 billion combined unfunded pension liability and $2.4 billion unfunded other post-employment benefits liability.

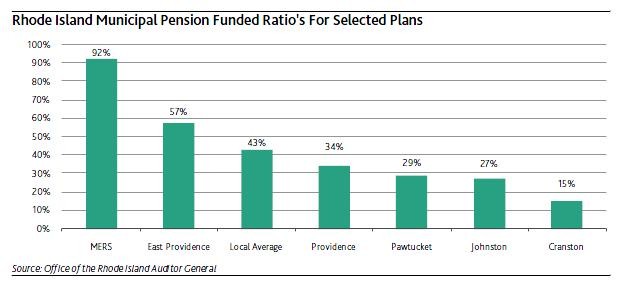

Currently, the 36 locally administered pension plans in Rhode Island have “weak” funding statuses with funded ratios averaging 43 percent as of March 2010, Moody’s said, noting the local plans present significant long-term credit pressures.

“Additionally, less than full funding of the annual required contribution is common. We expect these figures to decline further over the next few years as many municipalities have not conducted updated actuarial studies since 2008,” the service said.

The MAST fund, if enacted, would provide a total of $19.3 million of additional state aid to those municipalities that employ “fiscally prudent practices based on defined criteria.” Beginning in fiscal 2013, MAST payments would only be made to those municipalities that fully fund the ARC for their local pension plans or begin phasing in full funding over a five-year period.

Cities and towns would not be able to lower their pension contributions from fiscal 2012 levels; those that do not meet the funding requirements will see the state’s contribution to that municipality’s teacher retirement fund cut by 5 percent in fiscal 2014.

Moody’s also noted that legislation also establishes a similar funding requirement for the OPEB liability but allowing full ARC funding to be phased in during a ten-year period beginning fiscal 2014.

“While the proposal won’t immediately address the weak funded status of many plans, if enacted, it would be an important step toward improving funding levels and preventing underfunding in future years,” it said.

Moody’s also addressed the $6.7 million allotted in the proposed budget for Central Falls which currently has a B3 negative rating. The funds would go toward the city’s $1.5 million outstanding tax anticipation note, reduce its accumulated deficit and help close the fiscal 2012 structural budget gap, all of which the service highlighted as “credit positives.”

However, “while the funding could provide short-term relief, remaining challenges include addressing the long-term funding needs of the city’s deteriorating public safety pension plan,” Moody’s said.