NEW YORK – In the battle for gaming dominance, Hasbro Inc. has what it hopes is an ace up its sleeve – in a deck of playing cards that hit the market 26 years ago.

Not a standard deck, to be sure, but packs costing just $4 each that millions of devotees use to play Magic: The Gathering. Hasbro recently digitized it and has been testing an open beta version since September. The online incarnation is a hit, according to the company, and the payoff could be big after the official launch later this year.

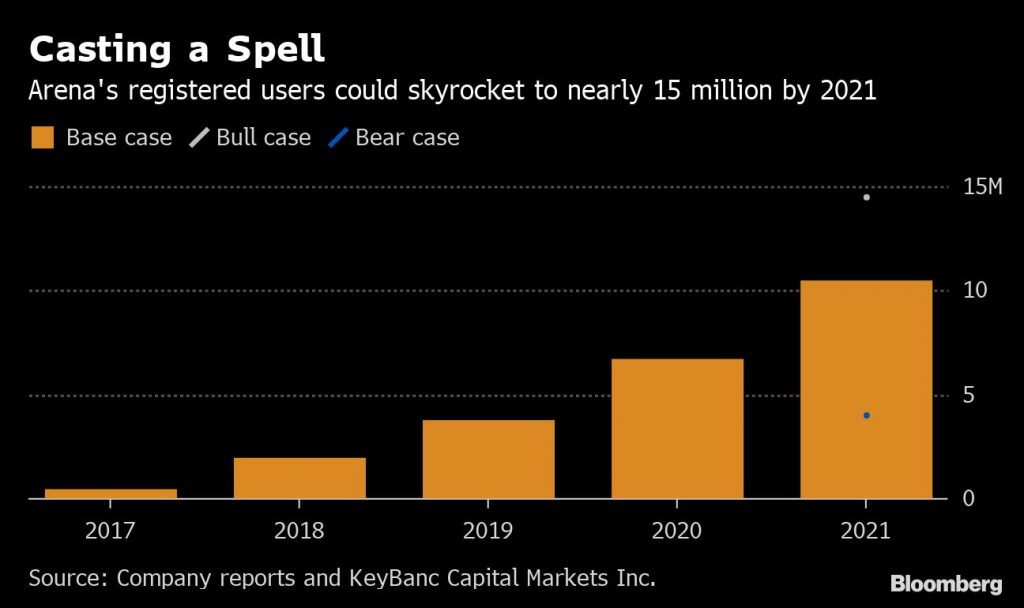

“This is one prong of their brand blueprint they’ve proven they can execute on,” said Brett Andress, an analyst at KeyBanc Capital Markets who sees Magic’s newest digital iteration adding as much a 98 cents a share in incremental earnings to results by 2021 – at least a 20% boost. “The writing is on the wall that this is going to be a very profitable platform for them.”

Hasbro acquired the card game’s owner, Wizards of the Coast, two decades ago, and left it virtually unchanged technology-wise. The low-tech Magic has been doing fine, attracting an enthusiastic following around the world. About 38 million people have played at least one round, the company says.

The expectation is that the PC-based version – called Magic: The Gathering Arena – will ultimately draw a bigger crowd. For one thing, at least 20 million one-time players of the card game have “lapsed,” Andress said. They’re part of the potential market for the online game, colloquially dubbed “Arena,” where players still stage battles between spell-casting wizards called planeswalkers but games are quicker to play.

The online game also doesn’t require people to leave the house to play with friends across town like the physical game does, giving Hasbro hope it will attract back some of the former fans who put down their cards to start families and full-time jobs. Nearly 3 million active users will be playing Arena by the end of this year, KeyBanc estimates, and that could swell to nearly 11 million by 2021 according to its bull case scenario – especially if it expands from PCs to mobile. That’s just active users, and registered users could be higher by the millions. Already, according to Hasbro, a billion games have been played online.

The online game also doesn’t require people to leave the house to play with friends across town like the physical game does, giving Hasbro hope it will attract back some of the former fans who put down their cards to start families and full-time jobs. Nearly 3 million active users will be playing Arena by the end of this year, KeyBanc estimates, and that could swell to nearly 11 million by 2021 according to its bull case scenario – especially if it expands from PCs to mobile. That’s just active users, and registered users could be higher by the millions. Already, according to Hasbro, a billion games have been played online.

Right now, there’s a market of about 250 million people who are into collectible- or trading-card games like Magic, according to Wizards of the Coast President Chris Cocks, whose unit also owns the Dungeons & Dragons property. Arena could “appeal to a very large number of those players.”

“To date, Magic has been something you can buy in stores, mostly hobby stores, but not everyone has a good hobby store in their home town,” he said. “We think digital is a great way to introduce a fantastic game to them with very low barriers to entry.”

Hasbro is banking on the game being more than a fun new product for fanboys. Magic is part of the company’s “franchise brands,” a segment that accounted for $2.45 billion in net revenue for the company last year, bigger than its emerging, partner and gaming brand units combined. Cocks said Magic accounts for a “meaningful portion” of that, with KeyBanc estimating the game’s contribution is already more than $500 million – including both the physical cards and the nascent digital version. Of the franchise brands, only Magic and Monopoly logged revenue gains last year, with Nerf, Transformers, Play-Doh and My Little Pony all down.

Cocks, who joined Hasbro about three years ago with the mandate of building Arena, entered the video game industry in 1999 when he joined Microsoft to work on a “secret, little-known project called Xbox,” he said. He helped launch the console, running publishing for games like Halo, Fable and Oddworld. By building the game in house instead of licensing the work out, Hasbro was able to maintain healthy margins on the project, KeyBanc’s Andress said. Hasbro also been working on a Magic series for Netflix.

Fueling growth is the maturing esports segment, which could be on track to challenge traditional sports in popularity and money. Hasbro CEO Brian Goldner said at a conference in May that Arena has become a top-10 brand for esports and on Twitch, a live streaming video platform where gamers can watch each other play. Wizards of the Coast has dabbled in digital riffs before – including early attempts to mirror the original table-top game – but none of those versions caught on in a meaningful way to expand the user base.

To be sure, Magic’s player ranks are still a drop in the bucket to rival Hearthstone, an Activision Blizzard Inc. game that has an estimated 70 million to 80 million registered users and earns annual revenue of more than $600 million, KeyBanc estimates.

But Magic has a lot of upside. Arena users are playing an average of eight hours per week, Hasbro’s Goldner says, and even though the game can theoretically be played for free, each player is spending about $75 annually on in-game currency, or “gems,” according to KeyBanc. And it’s these numbers that explain why Wall Street analysts are eager for more details from management on their quarterly earnings calls. “Arena” was mentioned 18 times on the company’s last earnings call, compared to six “Monopoly” references.

The paper-card version is not going away. But to encourage more users to try out Arena, Hasbro is funding elite tournaments with big prize pots where viewers can follow along at home. The Arena pro league has a $10 million prize pool, with 32 elite players on $50,000 contracts. Pro players can bank an additional $20,000 to stream on Twitch. Pro Arena player William “Huey” Jensen, 36, said the $70,000, in addition to individual sponsorships, easily puts him at more than $100,000 in annual earnings.

“I’ve been through every sort of different way that professional Magic existed: when it was purely paper, when it was a bit more online and now where we have Arena,” said Jensen, who entered the Magic Hall of Fame in 2013 when he was still playing the physical card game. He then took off a few years from Magic to compete in poker instead, before returning to competitive play via Arena’s pro league. “Clearly from my perspective, Arena is the product of the future for sure.”

Joe Deaux is a Bloomberg News staff writer.