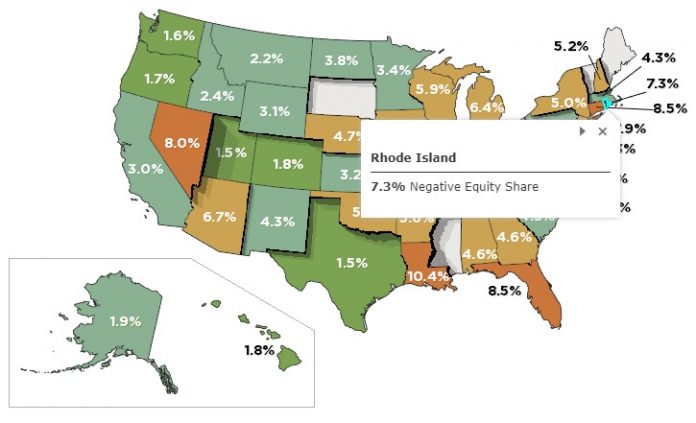

PROVIDENCE – Despite seeing an average homeowner equity gain of $20,000 in 2017, Rhode Island still ranked No. 39 on a list of states with the least negative equity, according to real estate analytics company CoreLogic. Thus, while the Ocean State is well below the high-water mark of negative equity nationally set in the fourth quarter of 2009 at 26 percent, there are still 7.3 percent of mortgaged residential properties that owe more than the property is worth.

Nationally, 4.9 percent of all mortgaged properties were underwater (have negative equity) at the end of 2017, a decline from 6.3 percent a year earlier. Homeowners with mortgages make up for nearly two thirds of all properties. In the last year, they have seen their equity increase on average by 12.2 percent – or $908.4 billion in total, according to the report. In terms of nominal value, homeowners with mortgages gained more than $15,000 in home equity on average across the United States, according to the fourth quarter analysis by CoreLogic.

“Because wealth gains spur additional consumer purchases, the rise in home-equity wealth during 2017 should add more than $50 billion to U.S. consumption spending over the next two to three years,” said Frank Nothaft, CoreLogic’s chief economist, in a prepared statement.

Rhode Island did not have the highest negative equity value in New England. That distinction belonged to Connecticut, where 8.5 percent of mortgaged homes were in a negative equity situation. Massachusetts had the lowest negative equity value, at 4.3 percent, while New Hampshire saw 5.2 percent of its mortgaged homes underwater. Maine and Vermont were not included in the analysis. The state with the lowest negative equity was Utah, at 1.5 percent, while the highest percentage of negative equity was in Louisiana, at 10.4 percent.

Among major cities, Boston had 3.7 percent of properties that were underwater. San Francisco had the lowest level, at 0.6 percent, while Miami was the highest, at 13.1 percent.

The report determined equity value by comparing a property’s estimated current value against its mortgage debt outstanding.

Kate Talerico is a PBN contributing writer.