PROVIDENCE — The R.I. Office of the Health Insurance Commissioner has released the rate increase requests of the state’s four largest insurers for individual, small, and large group market premium rates, part of the 2018 rate review process for rates effective in 2019.

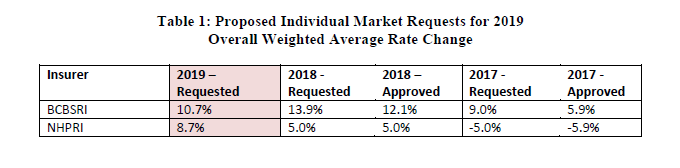

Blue Cross Blue Shield of Rhode Island and Neighborhood Health Plan of Rhode Island filed plans to be sold on the individual market for people not insured through their employer.

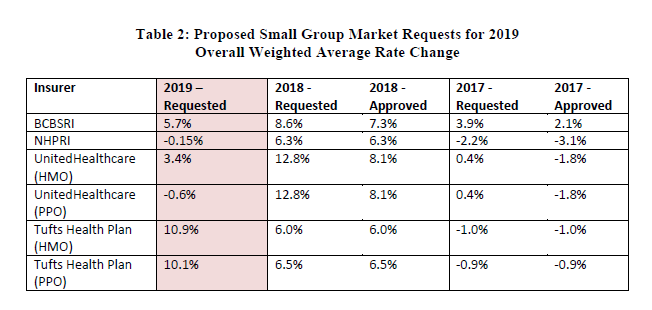

UnitedHealthcare and Tufts Health Plan filed small group market plan rate increase requests.

BCBSRI requested a 10.7 percent increase for its individual market plans, while NHPRI requested an 8.7 percent increase. Those plans’ requests were 13.9 percent and 5 percent for 2018, respectively, of which OHIC approved 12.1 percent (for BCBSRI) and 5 percent (for NHPRI).

Small group rate changes ranged from a decrease of -0.15 percent for NHPRI, as opposed to an approved increase of 6.3 percent last year, to a 5.7 percent increase for BCBSRI, as opposed to an approved 7.3 percent increase last year.

HMO small group market rate increase requests ranged from 3.4 percent for United Healthcare to a 10.9 percent increase request for Tufts Health Plan.

PPO rate requests ranged from a decrease of 0.6 percent by United Healthcare to an increase of 10.1 percent by Tufts Health Plan.

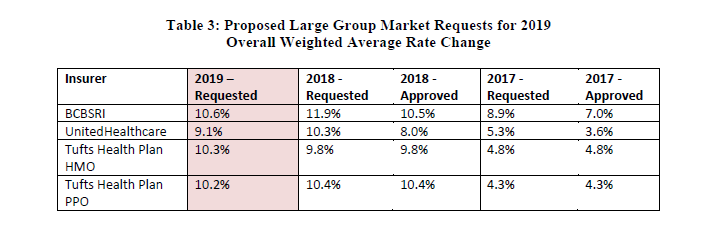

Large group rate changes range from an increase of 9.1 percent for United Healthcare, which was approved for an increase of 8 percent last year, to a 10.6 percent increase for BCBSRI, which was approved for a 10.5 percent increase last year.

Tufts Health Plan’s HMO rate request was for a 10.3 percent increase, which was approved for a 9.8 percent increase last year. Tufts Health Plan requested a 10.2 percent increase for its PPO, which was approved for a 10.4 percent increase last year.

Factors influencing the rate requests include increases in the cost of health care services, such as prescription drug cost trends, the agency noted in its announcement.

Uncertainty over federal policy concerning the Affordable Care Act, including discontinuing Cost Sharing Reduction subsidies and zeroing out penalties for not having health insurance, stand to affect insurance rates and markets nationwide, OHIC noted in a statement Wednesday.

OHIC will accept public comment on the proposed rates through July 27. Comments may be submitted in writing via email to OHIC.HealthInsInquiry@ohic.ri.gov or via postal mail to Office of the Health Insurance Commissioner, 1511 Pontiac Ave., Building #69, Cranston, RI 02920.

OHIC will also hear public comment in person at a public input meeting to be held in June, with the time and venue to be announced.

The reviews will be conducted under OHIC’s annual rate review process, except for BCBSRI’s individual health plans. BCBSRI’s individual plans are subject to a separate rate review hearing that is required by Rhode Island law in the event that the filed overall weighted average increase exceeds 10 percent. OHIC will also review each health insurer’s contracts to ensure that plans sold in Rhode Island meet all benefit, access, and member cost sharing standards required by state and the federal law. OHIC’s final decision to approve, modify, or reject the proposed rates is expected in August.

Rob Borkowski is a PBN staff writer. Email him at Borkowski@PBN.com.