PROVIDENCE – Fiscal stimulus and mass vaccinations should bring short-term economic relief, but a long-term crisis marked by structural unemployment, inflation and a bond market “meltdown” looms large in the mind of Thomas Tzitzouris, director at Strategas Research Partners.

Tzitzouris painted a bleak economic picture during his keynote address for Providence Business News Economic Trends Summit, held virtually on Thursday morning.

In the short-term, Strategas’ models forecast “rapid acceleration” in the second quarter of the year, with real gross domestic product hitting 8% and a core consumer price index of 3% due to what Tzitzouris termed “income replacement” from federal aid.

A strong short-term performance in the housing market, which has seen record levels of activity amid continued low interest rates, also will contribute to a comeback later in the year, according to Tzitzouris’ forecast.

But when stimulus money runs dry and mortgage rates inevitably rise, state and national economies could be in trouble, Tzitzouris warned. In fact, the “overstimulating” federal aid competing with higher mortgage activity could cause a bond market collapse by the third quarter that jeopardizes not only the financial markets but economic recovery as well, he said.

Rhode Island may be hit particularly hard, with Strategas predicting that the state will among the top states affected by “deaths of despair:” job loss, structural unemployment and other long-term consequences of the mortality caused by COVID-19. It doesn’t help that the state has struggled to align the skills of its workforce with the needs of growth sectors or that municipal governments have been hampered by credit weaknesses, Tzitouris said.

“If Rhode Island has not found a long-term driver of growth by 2023, we’re going to be right back in the same position we were 12 months ago,” he said.

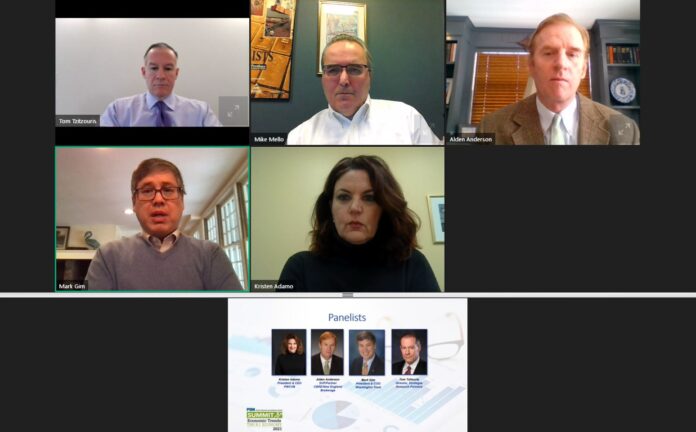

Still, there are some positives, as highlighted in a panel discussion, featuring Kristen Adamo, CEO and president of the Providence Warwick Convention & Visitors Bureau; Alden Anderson Jr., senior vice president and partner for CBRE/New England, and Mark W. Gim, president and chief operating officer for The Washington Trust Co.

Gim touted the success of the federal Paycheck Protection Program, which in its second iteration has proven much smoother and more accessible for lenders and business applicants alike, despite lower numbers of participation. While commercial real estate, particularly office space, has suffered from the shift to remote work, Anderson was confident that demand would rebound, particularly for well-capitalized landlords who can modernize their buildings with updated heating and ventilation systems and other health and safety precautions.

“There’s always going to be a need for well-planned quality office space where people can collaborate,” Gim said.

Tzitzouris framed tourism as a “bright spot” for the state economy as travel rebounds with an emphasis on beaches and nature over dense, urban destinations.

But Adamo offered a different take. Southern Rhode Island with its ample array of oceanfront scenery may benefit, but Providence and Warwick are preparing for a second summer of major losses with large-scale events and corporate meetings still on hold.

“I feel like I’m yelling that the sky is falling, but in Providence, it really is,” said Adamo, estimating that the city lost $70 million in direct spending in 2020 from events booked through her organization that have been canceled or postponed.

For Adamo, the keys to recovery include a strategic, long-term tourism plan and focused stimulus relief for Providence. Tzitzouris, meanwhile, looked to workers making mass exoduses out of New York City and Boston, who could make southern Rhode Island a new bedroom community for the remote or hybrid city young professional.

“What we need is to modernize the housing stock without eating into the rural and natural beauty,” he said.