Rhode Island businesses are climbing out of the crater caused by the COVID-19 pandemic, but many are finding that the lingering fallout is dampening their recovery, according to Providence Business News’ Summer 2021 Business Survey.

Nearly 9 in 10 business owners and executives who responded said they are paying more now for materials and supplies compared with the prior quarter, the highest rate in the 14-year history of PBN’s biannual survey and nearly double the number from a year ago.

At the same time, labor shortages have forced some companies to consider raising wages and improving benefits to stay competitive in a job market in which many workers now are in demand.

And more than one-third of respondents said they are still facing higher costs related to restrictions on how businesses operate, and nearly as many expect more-stringent regulations will have a lasting effect on the cost of doing business.

It doesn’t help that memories of lockdowns, mask mandates and rules curbing public gatherings are still fresh for businesspeople. Caution lingers because the trauma caused by the near shutdown of the economy last year is proving impossible to forget.

“It’s like a judge telling a jury to disregard what they just heard,” said Edward M. Mazze, a University of Rhode Island distinguished professor of business administration who helped develop the PBN survey.

There is no doubt the pandemic has touched off a shakeup of the business landscape. Sixty percent of survey respondents said the pandemic will change the way they do business in the long term. Only 10% said it would have no lasting effect.

But even in an upended environment, many businesses are mounting a comeback.

More than 6 in 10 report that net income has increased from a year ago, versus the 1 out of 4 who said the same thing six months ago. Business activity is also picking up, with two-thirds reporting quarter-over-quarter improvements in business activity, including new orders.

“The reality of this survey, every year but especially now, is that it’s about survival of the fittest,” Mazze said. “You can sit around and wait, and hope this thing disappears, or you can say, ‘These are the adjustments I need to make.’ ”

NOT-SO-DARK THOUGHTS

NOT-SO-DARK THOUGHTS

The PBN survey, which has been conducted twice a year since 2008, is not scientific. PBN sent 22 questions to 1,054 businesses in the newspaper’s database, including two questions specific to the pandemic. One hundred and five returned the surveys, representing a span of industries from banking and manufacturing to hospitality and health services. A few employ more than 1,000 people, but most are small and midsize companies.

The latest survey results indicate that most businesspeople have steadfast faith that Rhode Island’s economic picture will brighten soon – 57% of respondents believe the state’s economy will improve slightly or significantly over the next 12 months, about the same percentage as six months ago.

And the percentage of respondents who anticipated a better outlook for their own business in the next year was 62.5%, a number largely unchanged since the summer 2018 survey.

That level of confidence is quite different from when the economy was rocked in 2008 by a financial meltdown that kick-started the Great Recession. In PBN’s summer 2008 survey, only about 24% of the businesses said they believed conditions in the state would improve slightly or significantly over the next year. And in the six months after the 2008 recession hit, optimism among respondents about their own business took nearly a 20-percentage-point plunge, with less than 40% foreseeing improvement at their company in the next year, the lowest result in survey history.

Why the buoyant outlook this time around?

It may have something to do with the way government aid was deployed in each crisis, according to Mazze.

In 2008, relief programs were aimed mostly at banks in an effort to bail out some large financial institutions and ease a credit crunch that stifled business activity. This time, help was directed to small businesses and the general public. Stimulus checks appeared to bolster consumer confidence and spending, and initiatives such as the Paycheck Protection Program loans served as a life raft for struggling businesses.

Best Practice Energy LLC received a $330,000 PPP loan while in the depths of the pandemic, which helped the South Kingstown energy consulting company limp through 2020 and into a “dreadful” start to 2021, according to founder and President Bryan Yagoobian.

When the pandemic hit, a pipeline of new prospects was instantly crushed. And existing corporate clients who relied on Best Practice Energy to broker deals with natural gas companies evaporated.

“People didn’t want to hear about changing vendors or saving a few dollars on energy costs because they were in survival mode,” Yagoobian said.

He empathized. While Best Practice Energy scraped by, relying on the health care and manufacturing clients who saw energy use increase during the pandemic, it was not easy.

The transition from face-to-face client meetings to those through computer screens was initially fraught with problems: malfunctioning software, cameras unexpectedly turning off. Virtual meetings and client hesitancy also lengthened the time it took to close a deal – sometimes taking a year where deals once would have been finished in six months.

Best Practice Energy has bounced back in recent months as corporate clients return and the pipeline of prospects flows again.

The forgivable PPP loans were helpful for businesses such as Best Practice Energy to get over the hump, although Yagoobian acknowledges feeling somewhat bitter about Gov. Daniel J. McKee’s decision to tax loans above $250,000. “It kind of felt like a cash grab,” he said.

[caption id="attachment_383041" align="aligncenter" width="1024"]

STILL GOING STRONG: Gerald Carlson, left, owner of car-frame repair shop Auto Rust Technicians in Cranston, speaks with Karr Thang, manufacturing manager. Confident about the future of his business, Carlson recently spent $500,000 to purchase a neighboring building to expand operations and is contemplating buying additional equipment. / PBN PHOTO/RUPERT WHITELEY[/caption]

PAYING THE PRICE

As revenue improves at many companies, new problems crop up. Among them: finding workers.

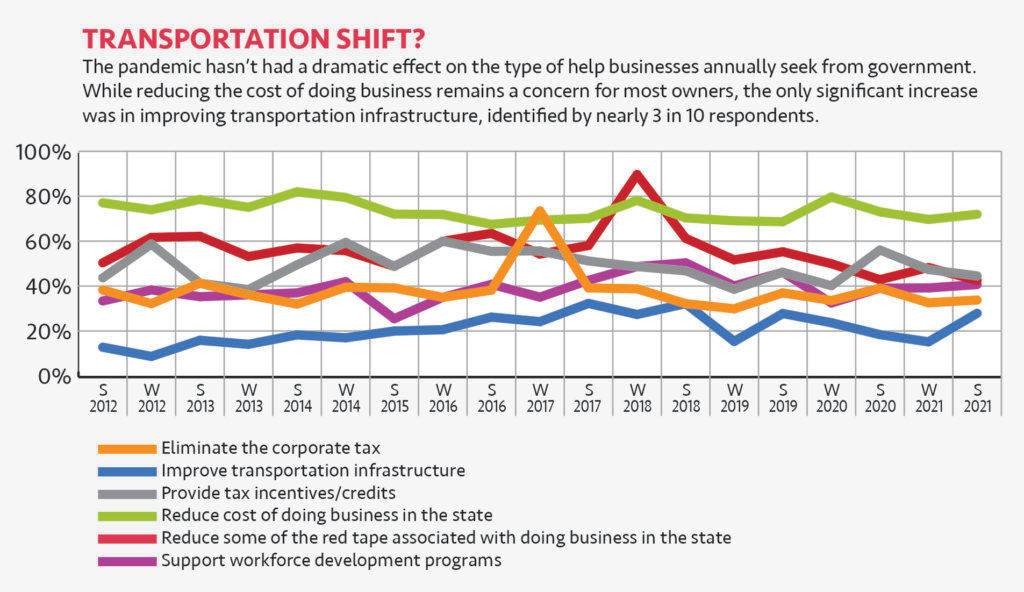

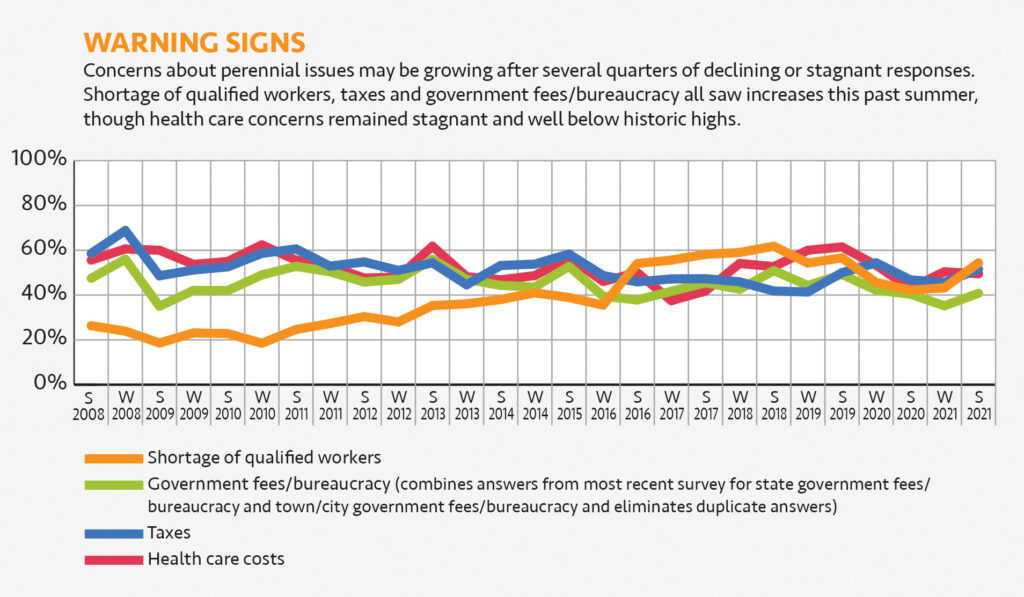

More than half of those surveyed said a shortage of qualified workers was one of the greatest challenges to operating a business in mid-2021. While this is similar to results in PBN surveys before the pandemic, employers say hiring has become much more difficult.

That’s in part because many job seekers are intent on finding remote work options, which they believe still abound as a result of early pandemic lockdowns. Many are no longer interested in the in-person opportunities that manufacturing, hospitality and health care industries require.

Vaccine mandates don’t help either.

After announcing its workers would have to get COVID-19 vaccinations in August, East Providence nursing and assisted living home Tockwotton on the Waterfront lost seven workers who were unwilling to comply, said CEO and President Kevin McKay.

That’s on top of at least 10 unfilled clinical positions within its 210-person workforce. The company offered bonuses and increased regular wages for workers throughout the pandemic, relying on a $1.2 million PPP loan.

But it’s difficult to compete in a labor market overflowing with openings.

“If McDonald’s is paying $15 an hour, why would I come work as a CNA [certified nursing assistant] or a med tech?” McKay said.

Masks, cleaning supplies and paper goods got more expensive too, cutting into companies’ bottom lines. It’s unclear whether the supply chain shortages causing these price hikes will continue.

As they pull purse strings tighter, a growing number of businesses appear to be ready to pass on a part of that higher cost to their customers by raising prices, if they haven’t already. Only 16.5% of respondents said they intended to raise prices next quarter, but that’s more than double the amount a year ago.

Fewer are dead-set against price increases, too. Nearly 50% of respondents said hikes were “under review” for next quarter, up from 41% a year ago.

Gerald Carlson, owner of Auto Rust Technicians, a Cranston car-frame repair shop, has already pulled the trigger.

He recently added a surcharge to offset the rising cost of steel, which has increased from 50 cents to $2 per pound in the last year.

He hasn’t gotten many complaints yet. But he is confident that even a few disgruntled customers would do little to undermine his company’s 45-year reputation.

“When you’ve been doing a good job for a long, long time, you’ve got a better chance of survival,” he said. “I have the momentum from doing 110% for 45 years.”

It helped that Carlson’s offshoot manufacturing company, SafeTCaps Inc., never shut down. In fact, demand for the car-frame repair kits that SafeTCaps Inc. makes – used by Carlson’s repair technicians and sold to customers who want to fix their vehicles themselves – spiked during the pandemic. There’s nothing like a lockdown to give people the push to take on a do-it-yourself project.

Carlson’s feeling so good about the future, he recently paid $500,000 for a building next to Auto Rust Technicians’ Niantic Avenue shop to expand operations. He was also thinking about buying additional equipment.

Other business owners are considering big buys, too.

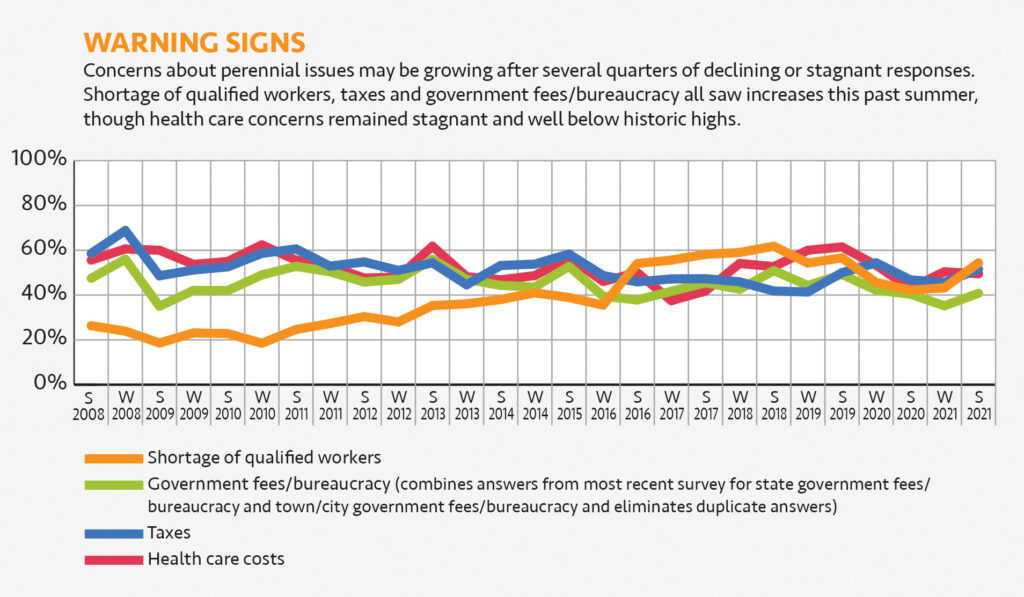

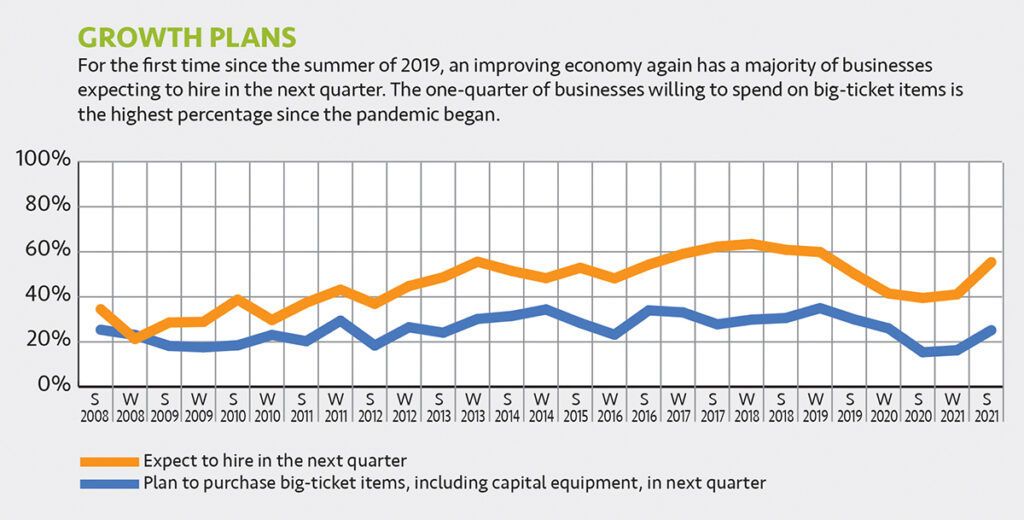

Business investments in space and equipment fell sharply in the last year, with plans for upcoming capital equipment purchases hitting the lowest number in PBN survey history at 15.2% in the summer of 2020. But as of the latest survey, buying plans are back on. One-quarter said they will be purchasing big-ticket items such as equipment in the next quarter, similar to pre-pandemic survey results.

To Mazze, the purchase plans offer further evidence that businesses have adjusted to the pandemic and are no longer letting the lingering uncertainty delay their expansion plans.

[caption id="attachment_383043" align="aligncenter" width="1024"]

HIRING HURDLE: Kevin McKay, CEO and president of Tockwotton on the Waterfront, a nursing and assisted living home in East Providence, speaks with Mariann Pari, director of nursing services. When Tockwotton announced in August that its workers would be required to get COVID-19 vaccinations, the organization lost seven workers who were unwilling to comply with the mandate. / PBN PHOTO/MICHAEL SALERNO[/caption]

HIRE UP

Investments in workers are also reemerging. More than 55% of businesses surveyed are adding workers next quarter, up from 41% six months ago, though still below the peak of 63% in the winter 2018 survey.

Bowerman Construction Inc., for example, was considering adding several new project manager positions to bolster its Providence workforce, said Principal Gregory Post.

After seeing growth flatline in 2020, Post was hoping to see business increase as commercial construction projects resume this year.

“We’re kind of waiting for that time when everyone waves the white flag and a lot of companies wake up and say, ‘Now, we’re going to proceed with our building project,’ ” Post said.

While labor and material costs strained the company during the pandemic, the biggest challenge is one that has plagued employers for years: health care.

“From the start of this survey, you would find it very difficult to find a businessperson who would disagree with the statement that health insurance costs are overly high,” Mazze said.

Nearly half of businesspeople surveyed named health care costs as a top challenge in the most recent survey – not the highest in the survey history, but a continued pain point for many, including Post.

His grievance with the annual increase in health insurance costs for employers might also reflect that while he has been working at Bowerman since 2013, he only took over as co-owner at the end of 2020. Previously, he worked as vice president of business development.

It’s not just the insurance plans themselves that jack up expenses, either. Even the administrative burden of negotiating with insurers requires time, expertise and costs beyond the company’s scope.

“We’re a small company, not in a big pool, so we’re kind of limited on our options,” Post said.

Nevertheless, as the survey indicates, Post and others are optimistic that the worst is over.

The pandemic forced changes at Newport Vineyards and Winery LLC in Middletown, but the business has adapted and is seeing things improve. It’s been a far different experience than what owner John Nunes Jr. went through during the 2008 financial crisis.

Back then, the vineyard was a small operation, focused on the rows of locally grown grapevines and wholesale bottle sales.

Now, the business is diversified, more about what Nunes called “agritainment:” the experience for the visitors who wine, dine and tour the 100-acre farm.

The coronavirus crisis did require alterations. Where customers once sidled up to the bar for a guided tasting, they now take a flight of glasses back to their tables to enjoy on their own. The drop-in clients have now been replaced by those with reservations, with each party limited to a 90-minute stay.

But while the company’s double-digit annual revenue growth slowed during the pandemic, revenue still increased, thanks to third-party sales and a large outdoor visiting area. In a way, Nunes figures, the vineyard is protected from a complete failure when a crisis such as this crops up.

“People drink wine in good times and in bad,” Nunes said.

Nancy Lavin is a PBN staff writer. Email her at Lavin@PBN.com.