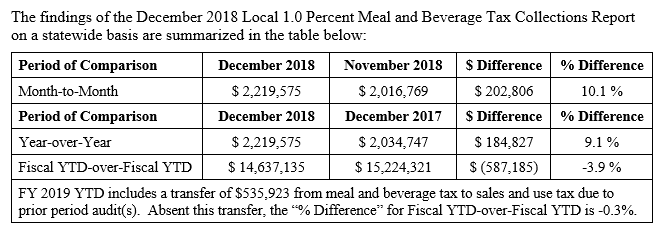

PROVIDENCE – Meal and beverage tax collections from Rhode Island restaurants declined 3.9 percent in 2018 to $14.6 million compared with the $15.2 million the state collected a year earlier, the R.I. Department of Revenue reported Friday.

Providence took in the most meal and beverage tax of any municipality in the state in 2018 at $2.5 million, but that was a $653,354 decline – or 20.9 percent – from 2017, the revenue department said.

Rhode Island requires all restaurants in the state to charge a 1 percent local tax on the sale of all meals and beverages. The numbers can fluctuate year to year based on factors such as weather or the scheduling of large special events that can boost the number of diners.

For the month of December, the state’s collections of the meal and beverage tax totaled $2.2 million, a 9.1 percent increase from $2 million collected in December 2018, according to state data.

While Providence saw a drop of $35,318 – or 7 percent – to $471,514 in December year over year, that decline was offset in part by large increases in Westerly and Narragansett. In Westerly, the collections grew from $5,638 in December 2017 to $116,586 in December 2018. In Narragansett, the tax revenue in the same period went from $9,636 to $32,904.

Aside from Providence, the three municipalities with the largest amount of the meal and beverage tax collected for 2018 were:

- Newport, $1.54 million, a year-over-year decrease of 1.7 percent

- Warwick, $1.49 million, a 4.3 percent decrease year over year

- Cranston, $1.01 million, a 2.3 percent increase year over year

William Hamilton is a PBN staff writer. Email him at Hamilton@PBN.com.