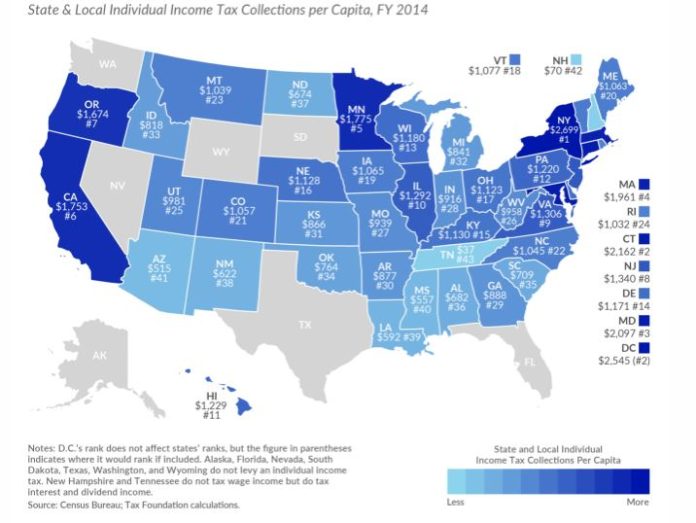

PROVIDENCE – Rhode Island ranked No. 24 for the highest average state and local individual income taxes per capita in the nation, according to a report from the Tax Foundation.

The study, which combines state and local taxes from fiscal 2014, reported that the average per capita state and local income tax in Rhode Island was $1,032. A year ago, Rhode Island ranked No. 23 in the nation. Three years ago, Rhode Island ranked No. 17 for the highest average per-capita state and local income burden in the nation. The 2017 calculation placed the Ocean State No. 2 in New England for the lowest state and local income tax per capita, following only New Hampshire.

New York had the highest state and local income taxes per capita in 2014, with an average $2,699 in collections. Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming did not have state and local income taxes in 2014. Tennessee had the lowest average per-capita state and local taxes of any state that had them, with an average of $35. Both Tennessee and New Hampshire only tax interest and dividend income.

Highest New England average state and local income taxes per capita:

Connecticut: No. 2 in nation: $2,162

Massachusetts: No. 4 in nation: $1,961

Vermont: No. 18 in nation: $1,077

Maine: No. 20 in nation: $1,063

Rhode Island: No. 24 in nation: $1,032

New Hampshire: No 42 in nation: $70

To see the complete Tax Foundation study, click HERE.