PROVIDENCE – In the federal Tax Cut and Jobs Act of 2017, there was a provision designed to encourage investment in low-income areas that will be designated as “opportunity zones.”

The areas that will be named as opportunity zones will allow investors to qualify for tax incentives by reinvesting capital gains into qualified “opportunity funds” that will privately fund real estate projects, new businesses and startups, and the expansion of existing businesses.

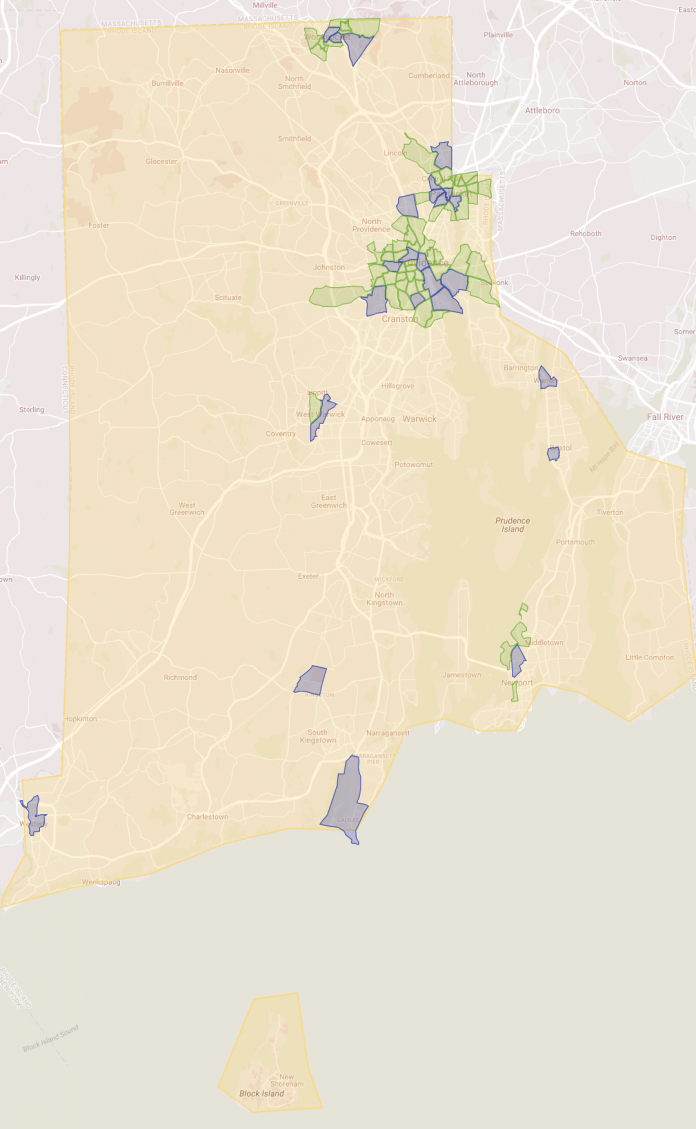

United States governors were authorized to designate 25 low-income census tracts.

Gov. Gina M. Raimondo nominated the maximum amount of tracts to the U.S. Treasury Department, she announced Monday. The poverty rate for each of the nominated areas in Rhode Island was greater than 27 percent in Rhode Island, a rate that is higher than the state and each tract had a higher poverty rate than the state’s overall poverty level, according to the R.I. Commerce Corp.

The state worked with a variety of local funds, nonprofits, state agencies and municipalities to decide on the nominated tracts.

The Treasury has until May 20 to certify the governor’s nominations.

The Internal Revenue Service is currently developing regulations regarding how the program will operate, including which qualified opportunity funds will be certified and which investments in a designated area will qualify for the program.

Commerce RI said that the program will focus on long-term investments allowing investors to defer taxes on capital gains on program-approved investments until 2026. The program’s incentives are designed to encourage investors to maintain investments in opportunity funds for up to 10 years, reducing taxes over time and eventually eliminating taxes on capital gains related to the investment at the 10-year mark.

The following Rhode Island municipalities had nominated opportunity zones:

- Bristol: One tract, (Tract 307)

- Central Falls: One tract (Tract 111)

- Cranston: One tract (Tract 147)

- Cumberland: One tract (Tract 112)

- East Providence: One tract (Tract 104)

- Narragansett: One tract (Tract 515.04)

- Newport: One Tract (Tract 405)

- North Providence: One tract (Tract 118)

- Pawtucket: Four tracts (Tracts 151, 152, 161, 167)

- Providence: Six tracts (Tracts 1.01, 2, 6, 8, 19, 25)

- South Kingstown: One tract (Tract 514)

- Warren: One tract (Tract 305)

- West Warwick: One tract (Tract 202)

- Westerly: One tract (Tract 508.01)

- Woonsocket: Three tracts (Tracts 179, 180, 185)

Chris Bergenheim is the PBN web editor.