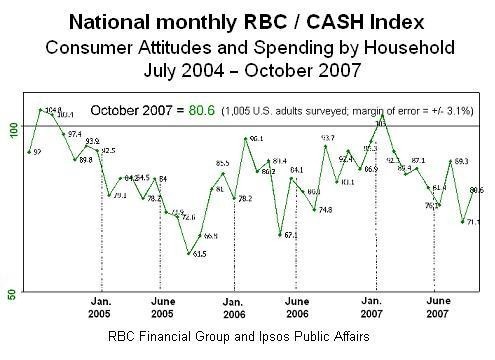

NEW YORK – Attitudes among U.S. consumers “improved considerably in October after tumbling to a 16-month low in September,” according to the RBC Consumer Attitudes and Spending by Household (CASH) Index released today.

“Consumer sentiment stabilized across all surveyed areas, with the biggest increases occurring in the areas of economic expectations and current conditions,” the RBC Financial Group report said. “However, this improvement was driven not by significant increases in consumer optimism, but rather a leveling out of pessimism. As a result, the RBC CASH Index for October 2007 stands at 80.6, up more than nine points from its 71.1 level in September.”

The RBC CASH Index – based on a monthly survey of consumer attitudes nationwide – has four components: a Current Conditions Index, an Expectations Index, an Investment Index and a Jobs Index. This month’s findings are based on responses from 1,005 individuals nationwide, polled by Ipsos Public Affairs early this week, and have a margin of error of plus or minus 3.1 percent.

“After collapsing in September, the RBC CASH Index rebounded in October, with consumers becoming more positive in the wake of the Fed’s rate cut and the calming of the financial markets,” T.J. Marta, economic and fixed income strategist for RBC Capital Markets, said in a statement today. “However, the lack of a complete recovery in the Index shows that August’s credit crisis has had a profound affect on consumers’ psyches, making them view the financial landscape warily.”

Consumers’ expectations improved significantly, with the Expectations Index rising 11 points to 25.7 in October from last month’s bleak score of 14.4 points, led by a decline in the share of respondents believing they or someone they know will lose their jobs.

The RBC Current Conditions Index surged more than 10 points to 101.1, from September’s 90.5 points, as the share of Americans rating their local economy as weak declined to 26 percent in October from last month’s 31 percent.

That same optimism about job security helped the RBC Jobs Index rise nearly 9 points to 122.5, rebounding from a September level of 113.6 that was the lowest this year.

The RBC Investment Index rose 4 points to 92.5, after falling nearly 10 points in September to 88.3, as respondents’ view of the investment climate also improved.

The RBC Consumer Attitudes and Spending by Household Index, based on a national survey of consumer attitudes, is published monthly by RBC Financial Group and Ipsos Public Affairs within 36 hours of the survey. Each RBC CASH survey includes 1,000 respondents, for a quarterly total of 3,000. For additional information, visit www.rbc.com.

No posts to display

Sign in

Welcome! Log into your account

Forgot your password? Get help

Privacy Policy

Password recovery

Recover your password

A password will be e-mailed to you.