BOSTON – A new report shows Americans are getting better at saving for retirement, but about half are not on target to have enough money to pay for their planned lifestyle.

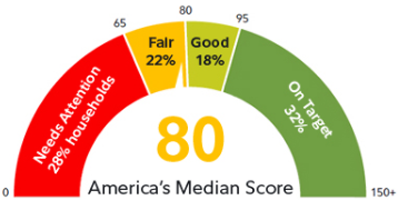

Fidelity Investments biennial retirement-savings study was released last week showing American savers are steadily improving their retirement preparedness. The report gave savers an overall score of 80, meaning the typical saver is on target to have 80 percent of the income they need to cover retirement costs, according to the report.

The number isn’t the ideal 100, but it does show improvement.

“This is a significant improvement from when the study was first conducted in 2005 when the score was 62,” according to the study.

Yet the study shows about half of the respondents surveyed are at risk of not being able to pay for essential expenses in retirement. The study surveyed more than 3,100 people. Fidelity created a range of retirement preparedness based on estimated retirement expenses in a down market, and the results are varied.

Roughly 28 percent of households are not on target and need significant adjustments to their savings to achieve their desired retirement lifestyles. Another 22 percent are not on target but only need modest adjustments to get there. About 18 percent are on target for essential expenses and 32 percent are on target to cover more than 95 percent of their total estimated expenses.

The study goes on to break down its finding based on age and offers some advice on how to think about planning. The full report can be found here.

Eli Sherman is a PBN staff writer. Email him at Sherman@PBN.com, or follow him on Twitter @Eli_Sherman.