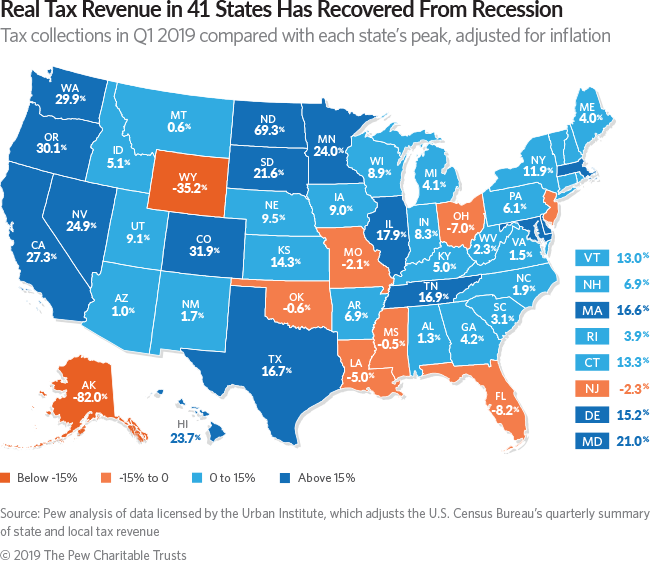

PROVIDENCE – Real tax revenue in the first quarter of 2019 in Rhode Island was 3.9% higher than the pre-recession peak in the third quarter of 2006, adjusted for inflation, according to The Pew Charitable Trusts Thursday.

Rhode Island revenues were 4.2% higher than the 2006 peak in the fourth quarter of 2018.

Nationally, the 50-state revenue was 13% higher than the pre-recession peak in the third quarter of 2008.

Q1 2019 New England real tax revenue versus pre-recession peaks:

- Massachusetts: 16.6% higher than in the third quarter of 2008.

- Connecticut: 13.3% higher than in the fourth quarter of 2007.

- Vermont: 13% higher than in the first quarter of 2008.

- New Hampshire: 6.9% higher than in the fourth quarter of 2007.

- Maine: 4% higher than in the fourth quarter of 2008.

- Rhode Island: 3.9% higher than in the third quarter of 2006.

Rhode Island was said to have the No. 16-least volatile revenue from fiscal year 1998 through fiscal year 2017 of all 50 states.

The Ocean State’s personal income collection from the fourth quarter of 2007 increased at an annual rate of 1.1% through the first quarter of 2019, the fifth-lowest rate in the country. The U.S. annual growth rate in that time was 1.9%.

Rhode Island was also said to be able to operate for 19 days on rainy day funds in fiscal 2018, lower than the 50-state median of 23.2 days.