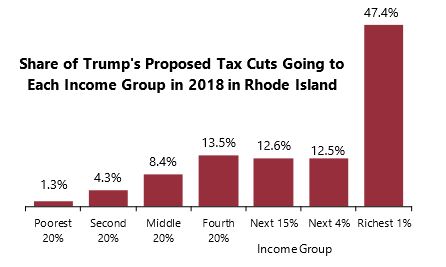

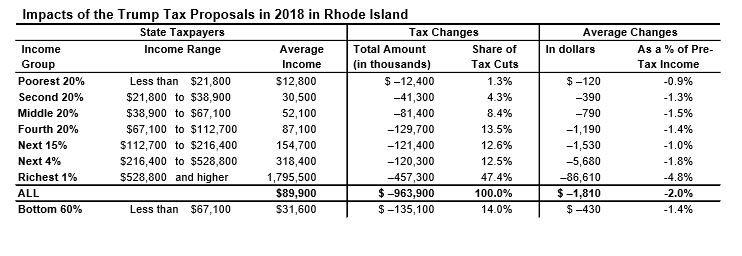

PROVIDENCE – President Donald Trump has spelled out a number of changes to the nation’s tax code, although no formal plan has been advanced. In a study published July 20, the Institute on Taxation and Economic Policy calculated the potential effects of the changes in all 50 states, and reached the conclusion that Rhode Island’s richest 1 percent would receive 47.4 percent of the tax relief in 2018 for the entire state.

The study examined the cuts’ effects on seven income brackets and found that the top 1 percent of earners will have an average income of $1,795,500 in 2018 and would receive a tax cut of $86,610 that year. This would be a 4.8 percent reduction as a percentage of pre-tax income, 3 percentage-points higher than any other bracket in the study.

Nationally, the top 1 percent of income earners would account for 61.4 percent of the value of tax cuts, with an average yearly tax decrease of 6.9 percent of pre-tax income, about $145,400 a year.

The next 4 percent, (those in the top 2-5 percent or earners) would receive an average $5,680 tax cut in 2018, accounting for 12.5 percent of the tax cuts in the state. The cut for the 2-5 percent top income earners would see a federal tax bill decrease of 1.8 percent as a percentage of their pre-tax income.

The top 20 percent of income earners in the state would account for 72.5 percent of all tax cuts in the state in 2018.

Those in the next highest quintile, whose incomes range from $67,100 to $122,700, would receive 13.5 percent of the tax cuts proposed, an average $1,190 reduction, about 1.4 percent of the bracket’s income pre-tax. The bottom 60 percent of income earners would account for 14 percent of all tax cuts in the state in 2018 with the proposed tax changes. The average tax cut for this group in 2018 would be $430.

The study also found that the potential changes to the tax code would reduce federal revenue by $4.8 trillion over 10 years.

“All too often, policymakers talk about tax cuts as though they don’t have consequences,” said Rachel Flum, executive director of the Economic Progress Institute in Providence. “But the truth is, tax cuts that largely benefit the wealthy would come with a heavy dose of cuts to vital programs and services. Reducing investments in health care, education, food assistance, disability insurance and other programs is too steep a price to pay to give Rhode Island’s wealthiest residents a tax cut that is more than the household income of most Ocean State working families.”

The ITEP considered the following of Donald Trumps proposed tax code changes:

- Repeal of the 3.8 percent tax on investment income

- Repeal of the alternative minimum tax

- Repeal of personal exemptions and doubling the standard deduction

- Replacement of current income tax brackets with three brackets, 10 percent, 25 percent and 35 percent

- Elimination of all itemized deductions except for charitable giving and home mortgage interest

- New deduction and tax credit for child care

- Repeal of special tax breaks for businesses and reduction in the corporate income tax rate from 35 percent to 15 percent

- Repeal of the estate tax

Chris Bergenheim is the PBN web editor.