PROVIDENCE – The Rhode Island Public Expenditure Council released its analysis of the Tax Foundation’s 2021 Business Tax Climate Index on Tuesday, offering recommendations that include rejecting calls to increase taxes on high-income earners.

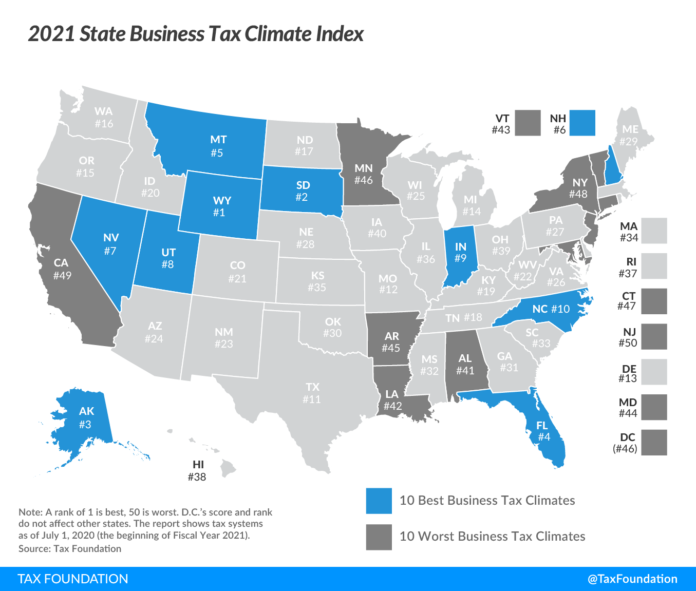

Released in October, the index found Rhode Island to have the No. 37 best business tax climate in the nation, a slight improvement from 39th in 2020.

Rhode Island ranked No. 4 among New England states in the 2021 index, behind New Hampshire (No. 6), Maine (No. 29), and Massachusetts (No. 34). The Ocean State ranked higher than Connecticut (No. 47) and Vermont (No. 43).

Rhode Island has been on a general trend of improving its ranking over the last six years. RIPEC said that while Rhode Island’s recent improvements in ranking on the index were a sign of positive change, the ranking was “hardly a cause for celebration.” RIPEC found that Rhode Island’s improved score and rank between 2020 and 2021 did not result from proactive policy choice, but instead because policymakers took no major action to harm the business tax climate.

“Policymakers should be recognized for efforts to substantially improve Rhode Island’s business tax climate, however, our rank is hardly cause for celebration as we are still in the bottom half of states,” said RIPEC president and CEO Michael DiBiase. “As the state faces a more challenging economic environment as a result of the pandemic, policymakers need to be even more vigilant to protect the progress we have made over the years and to continue to improve the competitiveness of our broad-based taxes.”

RIPEC recommended steps for the state to take to improve its ranking on the index, as well.

- The organization called on policymakers to reject a proposal to increase individual income taxes for high-income earners, saying that the individual income tax is the most heavily weighted tax on the index.

- The council also called for the state to explore changes to its corporate income tax to be more favorable to business. It noted that while the state’s overall ranking improved year to year, the state’s corporate tax ranking declined to No. 39 in the nation from No. 30 in 2018 due to decisions to forgo tax law changes consistent with the federal Tax Cuts and Jobs Act of 2017.

- RIPEC’s third recommendation was to improve the state’s ranking on property taxes, saying that businesses in the state, “often pay a disproportionate share” of property taxes due to allowance of split roll property taxation.

- The report also called for the state to resist increasing Unemployment Insurance benefit levels, noting that the COVID-19 pandemic will necessitate an increase in future UI taxes for businesses.

- The council’s fifth and final recommendation was that the state resist any pressure to increase revenue via tax increases that would affect businesses, despite the economic pressures of the COVID-19 pandemic, calling for policymakers to continue to pursue policies to make the state more business friendly.