PROVIDENCE – With the holiday shopping season at peak activity, SmartAsset is supplying shoppers with some guidance, as it reports on who does the best job with credit card debt. The personal-finance technology company noted in its report that carrying debt can be “bad for our physical and mental health,” while paying off credit card debt will lower stress levels “significantly.”

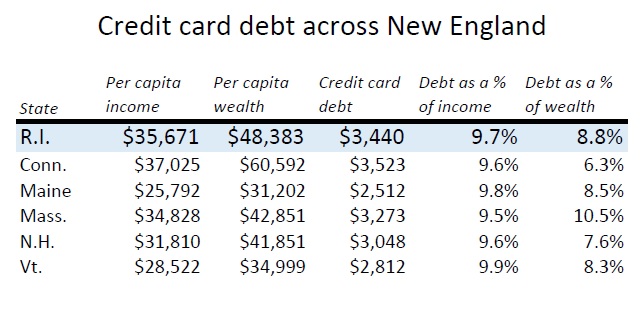

As a state, Rhode Islanders are better than the national average in terms of managing credit card debt. The Ocean State carries credit card debt per capita of $3,440, which comes to 9.7 percent of per capita income of $35,671 and 8.8 percent of per capita wealth of $48,383. Across the United States, Americans average 9.9 percent of per capita income in credit card debt and 11.1 percent of per capita wealth in credit card debt.

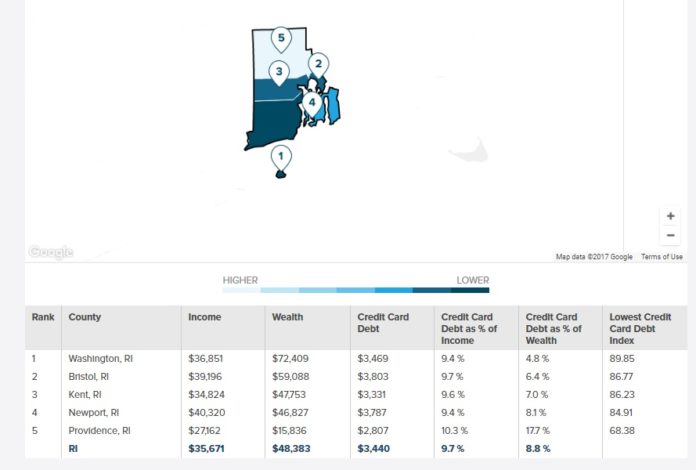

In Rhode Island, the residents of Washington County manage credit card debt the best, while the denizens of Providence County are the worst. Washington County residents carried credit card debt as a percentage of income of 9.4 percent, and as a percentage of wealth of 4.8 percent. Providence County residents, on the other hand, had credit card debt of 10.3 percent as a percentage of income and 17.7 percent as a percentage of wealth. Washington County ranked No. 48 in the nation in terms of its debt-to-wealth ratio, the highest ranking of any county in the state and the only ranking in the top 100.

Rhode Island ranked in the lower half of the New England states for its levels of credit card debt, as the following chart illustrates.

SmartAsset took the combined credit card debt for residents of each county and state, and divided it by the number of people residing there to come up with the credit card debt figure. SmartAsset then calculated credit card debt as a percentage of income as well as credit card debt as a percentage of wealth to create its rankings.

Mark S. Murphy is editor of PBN.