Despite the considerable promise of solar, wind and other renewable-energy sources to significantly broaden the state’s power portfolio, Rhode Island’s heavy reliance on natural gas is expected to continue for years to come.

Natural gas has recently accounted for more than 90 percent of Rhode Island’s electricity production, according to a December 2018 report by The New York Times, which examined each state’s fuel sources for electricity production dating back to 2001. It found the Ocean State has relied on natural gas for that purpose more than any other state.

See related story on offshore wind.

Natural gas is considered a cost-effective fuel, but it has not played out that way for Rhode Island consumers, who have had some of the highest electricity prices in the nation, for reasons related to regional energy markets and supply-chain logistics. In December, for example, Rhode Island had the highest average electricity prices in the 48 contiguous states, according to U.S. Energy Information Administration statistics.

And last fall’s deadly natural gas explosions in Massachusetts and this winter’s natural gas shutdown and evacuation on Aquidneck Island have heightened public concerns about the fuel’s safety and reliability.

Though natural gas is deemed cleaner than other fossil fuels, Rhode Island has been increasing its use of renewable energy in recent years through a combination of government and private-sector initiatives. The state has set a goal for electricity providers – including regulated and nonregulated power producers and distribution companies – to supply 38.5 percent of their retail electricity sales from renewables by 2035, achieved through small, annual increases.

Rhode Island is on pace to meet that goal, according to the R.I. Office of Energy Resources. The most recent report by the state Public Utilities Commission last April showed that Rhode Island got 10 percent of its retail electricity sales from renewables in 2016 (which is not the same as the source of energy produced here). The 38.5 percent goal for 2035 still would leave natural gas as the dominant energy source here, unless utility companies and others greatly exceed the goal, or they begin using more of other fossil fuels.

“Since 2016, we [have been] adding clean energy at an unprecedented rate,” said R.I. Office of Energy Resources spokesman Robert Beadle in an email. “We will achieve or exceed the target by utilizing a combination of technologies – solar, onshore wind, offshore wind, hydro, landfill gas and anaerobic digestion.”

POWER SHIFT

Across New England, conventional energy resources for generating electricity – nuclear, oil and coal – are in decline, mainly leaving natural gas and renewables to fill the void.

“Nuclear, oil and coal-fired power plants that operate with fuel stored on-site are retiring in greater numbers and they are being replaced by more natural gas-fired power plants and renewable resources,” said Gordon van Welie, president and CEO of ISO New England Inc., the nonprofit that manages the region’s power system. “The new resource mix is cleaner, but it is also dependent on the weather or timely natural gas deliveries.”

That could increase the risk for energy shortages, especially during winter cold snaps, when the region’s energy consumption typically peaks, Welie said.

“As the fleet shifts away from power plants with stored fuels to resources that depend on weather or just-in-time deliveries, the risk of insufficient energy is likely to expand to other times of the year as well,” he said.

Stephen Leahy, vice president of policy and analysis for the Northeast Gas Association in Needham, Mass., sees renewables as a complement rather than a competitor to natural gas.

“It’s not so much a threat as it is a natural evolution,” Leahy said. “The challenge with renewables is when the wind isn’t blowing, and the sun isn’t shining. [When] renewables aren’t running, natural gas can step in. It’s a reliable and cost-effective source as more renewables come online through the 2030s. Natural gas is a good balancing act for renewables.”

Welie said the retirement of nuclear, oil and coal-burning power plants is being driven largely by falling energy prices stemming from the low price of natural gas and the addition of large amounts of renewable energy – although environmental requirements are also a factor.

Meanwhile, energy-efficiency initiatives and related technologies and products are dampening demand across New England. ISO New England is projecting a slight decline in energy usage and peak demand over the next 10 years. Yet there are plenty of new energy projects on the table.

“The region has been losing oil, coal and nuclear plants, but proposals to build new generators are booming,” Welie added. “More than 150 projects totaling more than 20,000 megawatts are seeking to build in New England. Wind farms make up more than 60 percent of the new proposed megawatts. More than half of the megawatts from new wind farms would be offshore.”

In addition, nearly 160,000 small solar arrays are providing power directly to homes and businesses around New England. Accurately forecasting solar output requires accurate weather forecasts for the region, he said.

A vast majority of natural gas consumed in Rhode Island arrives via pipelines developed and operated by the Algonquin Gas Transmission Co. and the Tennessee Gas Pipeline Co. The remainder is transported as liquified natural gas to Rhode Island via tanker trucks. The Algonquin interstate pipeline transports natural gas from New Jersey throughout New England. The Tennessee interstate pipeline extends from the Texas/Mexico border to eastern Massachusetts.

National Grid Rhode Island, the state’s only natural gas distribution company, manages the retail delivery to end users in the state. National Grid’s local natural gas distribution system serves about 257,000 residential, commercial and industrial customers using a network of more than 3,200 miles of mains. National Grid also owns and operates three liquified natural gas storage facilities in the state.

One of those is at Fields Point near Providence’s marine terminal. In October, the Federal Energy Regulatory Commission approved National Grid’s request to build a $180 million natural gas liquefaction facility at Fields Point, despite local opposition. Work preparing for construction is expected to begin this month.

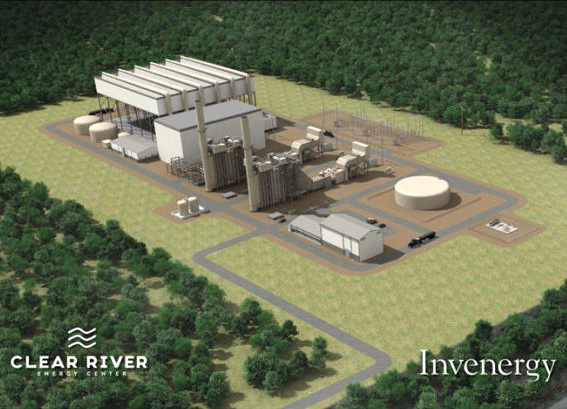

In addition, a natural gas-burning power plant being proposed by Chicago-based Invenergy LLC for Burrillville in the northwest corner of Rhode Island has faced opponents who argue the plant is not needed. Invenergy has argued that’s not the case, pointing to power plants that have closed or are planned to close in coming years around New England, and renewables alone won’t be enough to fill the gap. State utilities regulators are still considering the proposal.

But ISO New England’s most recent power-supply auction showed an electricity-generation surplus from June 2022 through May 2023, leading opponents of the Invenergy project to say it was not needed.

In Rhode Island and elsewhere, energy producers can meet renewable-energy requirements by either producing their own renewable energy or by purchasing credits for it.

Companies often buy renewable-energy credits or certificates as a method to meet different clean-energy requirements in each state. The certificates or credits serve as tradable energy commodities and as proof that a certain amount of electricity was generated from a renewable-energy resource and was fed into the shared power grid. The credits can be sold, traded or bartered, and the owner of the credits can claim to have purchased renewable energy.

“A lot of utilities buy clean-energy credits,” said National Grid spokesman Robert Kievra, “And the credits count toward the goal.”

How long natural gas remains dominant in Rhode Island “will depend on technological breakthroughs that … reduce prices for renewable energy,” said OER’s Beadle. “Five years ago, no one would have predicted that offshore wind would be offered in New England at the price the Revolution Wind [project] is offering.” National Grid projects ratepayers could save up to $91.6 million over 20 years due to the planned wind farm in federal waters off Rhode Island’s coast.

“These resources and other [regional] investments … will help reduce the region’s reliance on fossil fuel-based generation,” he said.

Scott Blake is a PBN staff writer. Email him at Blake@PBN.com.