PROVIDENCE – Direct banks continue to outperform traditional retail banks in overall customer satisfaction, but these branchless institutions are showing some signs of vulnerability.

Direct banks have no branch network, instead offering services remotely via online banking and telephone banking. They also may provide access via ATMs, mail and mobile.

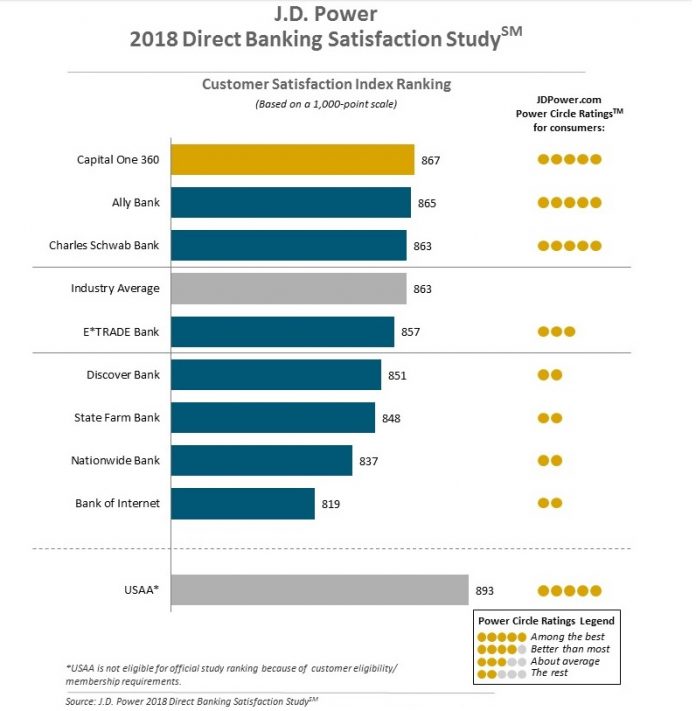

The 2018 U.S. Direct Banking Satisfaction Study by J.D. Power notes that direct banks have lost ground to traditional retail banks in terms of customer understanding and mobile experience.

“Direct banks have traditionally occupied a niche of the retail banking marketplace where they serve mainly as secondary banks,” said Bob Neuhaus, financial services consultant at J.D. Power. “However, these banks still represent less than 10 percent of industry deposit share and they are experiencing some deterioration in customer satisfaction.”

Key findings of the 2018 study:

- The overall satisfaction score for direct banks is 863, on a 1,000-point scale, which is 57 points higher than the score for traditional retail banks.

- More than three-fourths, or 77 percent, of direct bank customers indicate using the mobile channel, and customer satisfaction with the mobile channel has declined 8 points from last year, making it the channel with the narrowest performance lead compared to retail banks.

- Only 43 percent of direct-bank customers consider their direct bank to be their primary bank. Overall satisfaction among that group is 873, which is 18 points higher than among customers who consider their direct bank to be a secondary banking relationship.

- Social media is a key marketing channel for direct banks. Among direct-bank customers who opened a new product in the past 12 months, 38 percent say they were influenced by social media to open the new product.

If direct banks want to grow beyond their 10 percent customer base and evolve from a secondary to a primary bank relationship, J.D. Power notes, they need to focus on cross-channel consistency and ramp up their digital capabilities.

Mary Lhowe is a PBN contributing writer.