Tag: R.I. Department of Revenue

HELP WANTED: There are 1,700 unfilled state jobs, but has anyone...

Stacy Smith says the job for “front-line” workers at the R.I. Department of Human Services isn’t easy in normal times, but the labor market...

McKee taps former Providence police deputy to head state revenue department

PROVIDENCE- Gov. Daniel J. McKee on Thursday nominated Thomas A. Verdi, former commander and deputy chief of police for the City of Providence, to...

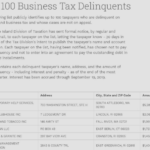

Should R.I. change the way it tries to collect from tax...

The amount of money owed by the state’s top income tax delinquents has grown 50% in the last five years to $65.2 million, which...

Should the General Assembly expand gambling in the state by approving...

Bally’s Corp. on Feb. 16 said it will ask state lawmakers to approve iGaming, which would allow residents and visitors to play slots and...

Can R.I. afford to say ‘no’ to Bally’s iGaming proposal?

The inextricable ties between Bally’s Corp. and state government will be on display as the General Assembly vets a request from the operator of...

Poker returning to Twin River Casino on Feb. 23

LINCOLN – After a three-year hiatus, poker is returning to Bally's Twin River Lincoln Casino Resort on Feb. 23.

The news was announced on Bally’s...

R.I. hotel tax collections up 20.6% in November

PROVIDENCE – Collection of the 5% hotel tax in Rhode Island in November increased 20.6% year over year to $1.5 million, according to the...

R.I. hotel tax collections up more than 4% in October

PROVIDENCE – Collection of the 5% hotel tax in Rhode Island in October increased 4.6% year over year to $2.5 million, according to the...

R.I. revenue director latest to step down in string of cabinet...

PROVIDENCE – Another one of Gov. Daniel J. McKee’s cabinet members has left.

Guillermo Tello, the state’s revenue director, has returned to work for the...

Will R.I.’s new registry discourage short-term vacation property rentals?

State business regulators are going to start taking names – and charging fees – of Rhode Island property owners who rent out their homes...