Tag: Taxes

IRS filing system has glitch as taxpayers race to meet deadline

NEW YORK - The U.S. Internal Revenue Service’s online filing system was experiencing malfunctions on Tuesday - the day tax returns are due for...

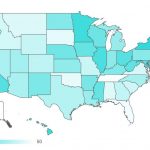

WalletHub: R.I. has 7th-highest tax burden in U.S.

PROVIDENCE - Rhode Islanders scrambling to put together their taxes ahead of April 17 may already be feeling the burden of Rhode Island’s tax...

Feeling taxed

When does your company begin preparing its taxes?

January: 75%

February: 25%

March: 0%

April: 0%

Is the time taken for your company to prepare taxes extensive?

Yes: 50%

No: 50%

How...

WalletHub ranks Rhode Island 27th in return on investment for taxes...

PROVIDENCE - Rhode Island was ranked No. 27 for best taxpayer return on investment in a WalletHub report Monday that ranked all 50 states in...

Recent IRS directive simplifies R&D tax credits

Credits for research and development are among the most significant tax-reduction opportunities available to businesses. As a result, taxing authorities give R&D activities a...

File, seal, deliver

Does your company hire a professional tax preparer to do its taxes?

Yes 81.8%

No 18.2%

Is filing your company’s taxes too complex a task?

Yes 72.7%

No 27.3%

Do...

ACA repeal may limit benefits of S corporations

Since the 2010 passage of the Affordable Care Act, the use of S corporations has seen a steady increase in popularity among tax advisers,...

Applying new accounting rules in various business situations

Editor’s note: Part I two weeks ago gave an overview of the new accounting rules and their potential impact on income taxes. Part II...

New financial reporting rules alter timing of revenue recognition

For accounting purposes, the seller or provider of services in a contract recognizes revenue when the buyer takes control of the good or service....

The trouble with taxes

How does your company prepare its taxes?

External accountant 87.5%

Internal staff member 0%

Both 12.5%

How much time is spent annually on federal taxes (i.e. filing payroll,...