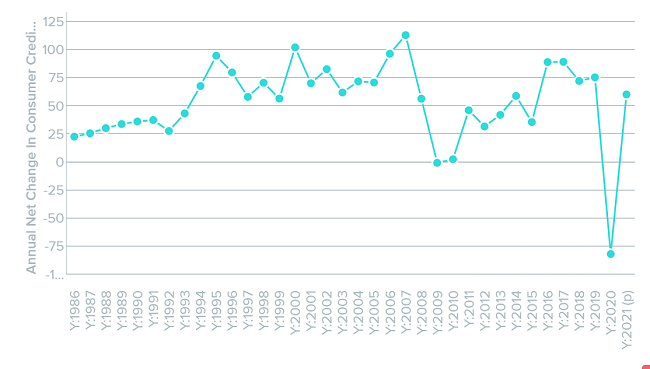

PROVIDENCE – After paying down a record $82.1 billion in credit card debt during 2020, consumers are projected to take on $60 billion more in credit card debt this year, according to a study from WalletHub.

WalletHub named the economic reopening post-pandemic as the reason why credit card debt levels will spike again this year. As of the first quarter, however, credit card debt nationwide has continued to diminish, with consumers paying down $56.5 billion in debt in the three month-period that ended March 31.

Outstanding credit card debt decreased 6.6% from the prior quarter, standing at $892 billion when adjusted for inflation. The average household balance nationwide was $7,519, which is 13.5% less than a year ago but still $2,485 above WalletHub’s “breaking point.”

Historical data shows credit card debt often declines in the first quarter of the year, then rises in subsequent quarters, often negating previous paydowns. Over the last 10 years, consumers have added an average $45.6 billion in credit card debt every year.

The study also ranked 182 cities nationwide based on average debt. Providence ranked No. 146, with $10,185 in credit card debt per household, with a $688 average paydown in the first quarter.

Santa Clarita, Calif., had the most average debt at $18,462 per household, while Detroit had the lowest at $8,089.

Nancy Lavin is a PBN staff writer. You may reach her at Lavin@PBN.com.