PROVIDENCE – The Office of the Health Insurance Commissioner released its approved health insurance premium rates for 2020 Tuesday, saying it has saved Rhode Island consumers $15.6 million by cutting insurers’ proposed rate increases.

Large-group market insurance rates were approved for rate increases ranging from 8.1% to 10.6% for 2020.

Small-group insurance rates were approved for rate changes ranging from a decrease of 0.09% to an increase of 11%, according to OHIC.

Individual market health insurance rate changes for 2020 ranged from a decline of 1.5% to a decline of 0.2%, with declines bolstered by a newly federally approved state reinsurance program.

A number of factors, primarily the rising cost of health care, contributed to the changing rates, OHIC said.

“Rhode Island has made significant strides in controlling costs this past year,” said Health Insurance Commissioner Marie L. Ganim. “Alongside premium savings through OHIC’s rate-review process, the passage of the reinsurance program in the state budget is critical for families and sole proprietor businesses who receive no federal assistance to pay for their health insurance premiums. Although we have been able to reduce rate increases by $15.6 million in 2020, we know that high health insurance costs remain a burden for individuals and companies in the state.”

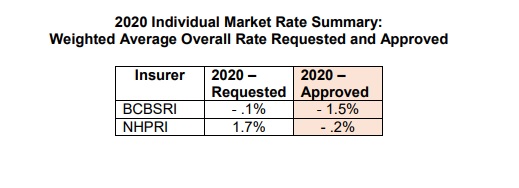

2020 individual-market rates:

Both individual market plans for 2020 decreased as a result of a $14.7 million reinsurance program that makes use of federal and state money to keep premium prices down for the next five years.

As a result of the program, Blue Cross & Blue Shield of Rhode Island was approved for a 1.5% decrease for individual rates, larger than its requested 0.1% decrease, while Neighborhood Health Plan of Rhode Island was approved for a 0.2% decrease after requesting a 1.7% increase for individual rates.

“We are thrilled that as premiums continue to increase across the country, Rhode Islanders on the individual market will actually see their premiums go down,” said Gov. Gina M. Raimondo, who included the reinsurance program in the state’s 2020 budget.

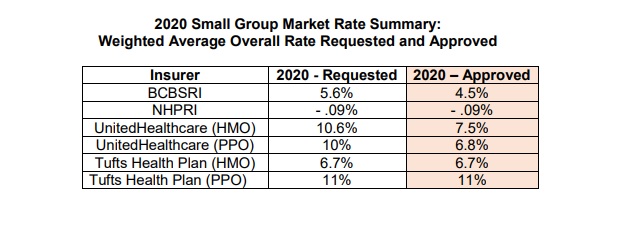

2020 small-group market rates:

The weighted-average rate-change approvals for the small-group market PPO plans ranged from a 6.8% increase for UnitedHealthcare to an 11% increase for Neighborhood, whose increase was the largest overall increase in the state of all plans, large group, small group and individual.

The rate request by the Tufts Health Plan HMO, or health maintenance organization, for the small-group market was approved at a 6.7% increase. United’s HMO rate request of 10.6% was trimmed to 7.5%.

Blue Cross’ 5.6% rate increase was trimmed to 4.5% for 2020, while Neighborhood’s request for a 0.9% decline in its rates was approved as is.

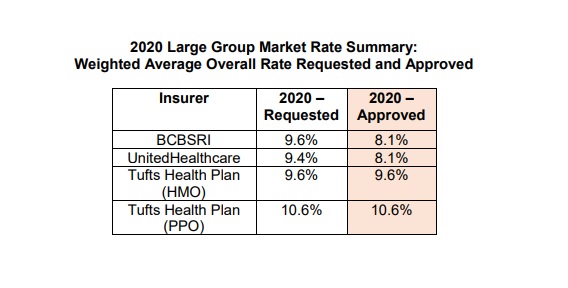

2020 large-group market rates:

Large-group commercial market approval rates ranged between increases of 8.1% and 10.6%.

Tufts Health Plan PPO’s requested 10.6% increase was approved by OHIC, at the same time that its increase request of 9.6% was approved. Blue Cross’ request for a 9.6% increase was reduced to an 8.1% increase for 2020, and UnitedHealthcare’s 9.4% increase request was also reduced to an 8.1% increase.

Elizabeth Graham is a PBN staff writer. Email her at Graham@PBN.com.