Tag: CoreLogic

R.I.’s share of mortgage delinquency rises to 6.1% in Sept.

PROVIDENCE – The share of mortgages in delinquency of 30 days or more in Rhode Island totaled 6.1% in September, a 1.7 percentage point...

R.I. HPI grows 9.8% Y/Y in Oct.

PROVIDENCE – The home price index in Rhode Island increased 9.8% year over year in October, CoreLogic said on Tuesday.

The increase was the third-highest...

R.I. mortgage delinquency rises to 6.3% in August

PROVIDENCE – The mortgage delinquency rate of 30 days or more in Rhode Island was 6.3% in August, a rise from 4.5% one year...

R.I. HPI grows 9.1% Y/Y in Sept.

PROVIDENCE – The home price index for a single-family home in Rhode Island increased 9.1% year over year in September, the third highest rate...

R.I. mortgage delinquency in July hits 6.2%

PROVIDENCE – The share of mortgaged homes in Rhode Island delinquent by 30 days or more was 6.2% in July, CoreLogic said Oct. 13.

The...

R.I. mortgage delinquency in July hits 6.2%

PROVIDENCE – The share of mortgaged homes in Rhode Island delinquent by 30 days or more was 6.2%, CoreLogic said on Tuesday.

The rate of...

R.I. HPI rises 7% Y/Y in August

PROVIDENCE – The home price index in Rhode Island increased 7% year over year in August, faster than the national rise of 5.9%, CoreLogic...

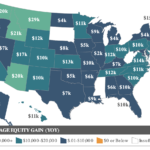

R.I. negative-equity rate declines to $3.8% in Q2

PROVIDENCE – The share of mortgaged homes in negative equity in Rhode Island declined to 3.8% in the second quarter, CoreLogic said on Monday.

The...

R.I. June mortgage delinquency rate rises to 6.6%

PROVIDENCE – The share of mortgages in Rhode Island that were delinquent 30 days or more in June was 6.6%, an increase from 4.7%...

R.I. June mortgage delinquency rate rises to 6.6%

PROVIDENCE – The share of mortgages in Rhode Island that were delinquent 30 days or more in June was 6.6%, an increase from 4.7%...