Tag: Economic Progress Institute

Campaign champions long-term home care independence

PROVIDENCE – The desire to stay in your home as you age is a given for most, but law and policy don’t support that...

Uncertainty reigns on impact of tax changes

Anyone who thought the new tax law would result in a simpler tax code would be sorely mistaken.

If anything, parts of the sweeping new...

Congress to finally debate tax reform

President Donald Trump’s tax plan pledges to reduce the complexity of the federal tax code, to benefit small businesses, corporations and middle-class Americans.

But how...

United Way honors McFarland for leading RICCA

When it comes to giving in Rhode Island, there may be no more powerful force than the Rhode Island Community Action Association. But its...

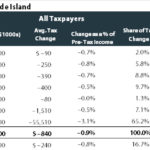

Report: Proposed tax changes would mostly benefit top 1% of R.I....

PROVIDENCE - The latest proposed tax reform framework supported by President Donald Trump and U.S. House Speaker Paul Ryan would disproportionately benefit the top...

Report: R.I. has highest poverty rate in New England; 4th highest...

PROVIDENCE - Rhode Island ranked No. 25 for highest poverty rate in the nation, according to 2016 American Community Survey from the U.S. Census Bureau released...

R.I. 6th best in nation for health insurance enrollment

PROVIDENCE - U.S. Census Bureau data from the 2016 American Community Survey shows more Rhode Islanders were covered for health insurance in 2016 than...

Behind seemingly positive employment data is structural weakness that in the...

Sean DeLong, 42, has applied for more than 800 jobs in Rhode Island and southeastern Massachusetts since November 2015.

On average, he gets about one...

Rhode Island must pursue revenue growth

Chicken Little and the elephant in the room: Is the revenue sky really falling?

As we approach the end of the 2017 General Assembly, there...

Who pays for R.I. car-tax cuts?

The car tax in Rhode Island is so unevenly collected and disproportionately important to town coffers that reducing it raises a host of secondary...