Tag: Tax Cuts and Jobs act

CVS files federal lawsuit seeking $400M in tax refunds

WOONSOCKET – CVS Health Corp. has filed a lawsuit against the U.S. seeking a refund of federal income taxes to the tune of more...

Limited Deductibility of Research and Experimental and Software Development Costs

Barring any further legislation, calendar year taxpayers will not be allowed to fully deduct research and experimental (R&E) costs or software development costs when...

What’s powering the economy? Frankly, it’s a mystery

The U.S. economy’s steady growth – the longest stretch since World War II without a recession – is something of a mystery. Last summer,...

Federal tax act may be enticing foreign firms

Nearly 2,220 foreign businesses operated in Rhode Island in 2017, according to data from the R.I. Secretary of State’s Office.

But after the federal tax...

Opportunity zones: The last great neoliberal experiment

The opportunity zones created by the federal tax reform of 2017 have all been set up, and the money has started to flow. When...

Proving value key to preserving donations

The new federal tax law implemented this year – with a doubling of the standard deduction amount allowed for individuals and married couples –...

All 25 R.I. ‘Qualified Opportunity Zones’ approved by feds

PROVIDENCE – All 25 areas that Gov. Gina M. Raimondo and the R.I. Commerce Corp. submitted for designation as “Qualified Opportunity Zones” were approved...

2017 federal tax law likely to squeeze revenue for parts of...

PROVIDENCE - The federal Tax Cuts and Jobs Act of 2017 is likely to create benefits for some municipalities and burdens for others, mainly...

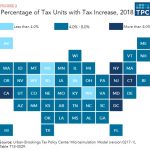

Report: 64% of R.I.ers getting tax cut, 7% tax increase in...

PROVIDENCE – Fewer then two-thirds of Rhode Islanders will see a tax cut on their 2018 federal tax bill, according to calculations done by...

Summer Infant reports net loss of $2.2M in 2017, driven by...

WOONSOCKET – Summer Infant Inc., creator of infant and juvenile products, reported a $2.2 million loss in 2017, driven by a one-time $1.7 million...