If you are 55 and have worked for five years at Citizens Bank or Blue Cross & Blue Shield of Rhode Island, you’re eligible to retire. But the companies, two of Rhode Island’s largest employers, would rather you not.

They don’t have much of a choice. Rhode Island’s population 55 and older is the state’s fastest-growing age cohort, according to a report released Feb. 7 by The New England Council, a nonprofit dedicating to promoting economic development in the region.

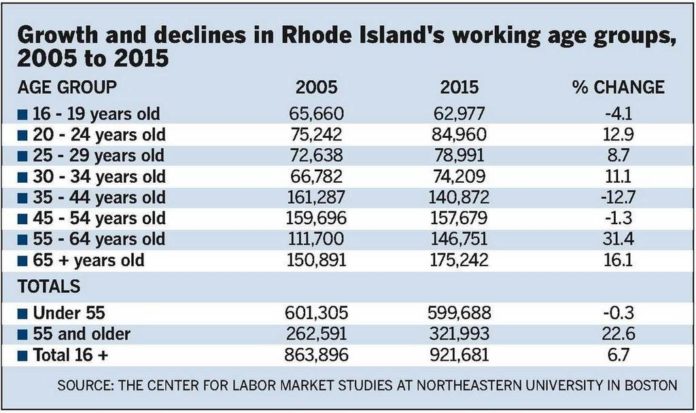

By 2015, the 55-and-older population will have grown by 22.6 percent, while the 54-and-younger crowd will have declined 0.3 percent. That means older workers have become the new growth sector of labor supply, making them a target for retention, according to the study, which was prepared by the Center for Labor Market Studies at Northeastern University in Boston.

Citizens is already preparing for the post-retirement re-recruitment of its 5,500 Rhode Island employees.

Once employees retire, they can continue to work 120 hours per month while collecting retirement benefits, said Katherine McKenzie, group executive vice president for human resources at Citizens. Retirees 70-1/2 and older can work full-time while receiving retirement benefits.

But McKenzie said the greatest incentive for older employees to keep working is not the bank’s new retirement policy. It’s the fact that most baby boomers can’t afford not to work, because they have saved less than $60,000 for retirement.

That, compounded with the fact that they can’t collect full Social Security benefits until they’re 65 or 66 – the age is gradually being increased, in two-month increments, so it’s 65 for people born in 1937 and 67 for those born in 1960 and after – makes working more desirable.

The average retirement age at Citizens is 64-1/2.

Citizens’ new system is exactly what companies are going to have to start thinking about, according to the New England Council study.

But employers are going to need to do a better job of accommodating the needs of older workers. “Re-hiring a mature worker is not a one size fits all,” McKenzie said. “They want flexibility to come and go as they please.”

Blue Cross is studying the effects of implementing flexible work schedules in addition to job sharing for retirees, after the company adopts a retirement policy similar to that at Citizens, said David Wiggins, the company’s director of human resources.

It is clear something will have to be done, he said, considering that the average age of Blue Cross’ 1,100 employees increased by a year and a half, from 41-1/2 to 43, between 2002 and 2007. The average age of employees at Citizens is 40.

This year, Blue Cross is augmenting its job-shadowing plan for younger workers by implementing a formal succession planning system. It also is using its corporate university program as a retention tool, Wiggins said. The program pays for employees to take online courses and workshops related to health care.

But there is more to be done.

Work force development programs will need to be re-examined and refocused to meet the needs of the older work force, according to the study.

Rhode Island also will have to deal with a relatively slow-growing working-age population. The study suggests the state’s population aged 16 and older will grow by 6.7 percent between 2005 and 2015. That is 3.3 percentage points behind the national projection of 10 percent.

“We’re behind just about every other region in the country,” said James T. Brett, president and CEO of The New England Council. “We have the slowest growth in our population than any other region.”

Brett said that could be due to the high cost of living or the climate or any number of reasons pushing people out of the region. Or, it could be the slow birth rate; in 2004, Rhode Island had the sixth-lowest birth rate among the 50 states.

The council hopes to have a study of each New England state’s aging work force completed by June, so it can present a white paper to Congress, Brett said. “If we don’t address this, it could stall New England’s economic development.”