CHICAGO – General Growth Properties Inc. (NYSE: GGP), the owner of Providence Place and the Silver City Galleria in Taunton, was removed from the Standard & Poor’s 500 Index after the close of trading yesterday.

The financial ratings and data company, a division of the McGraw-Hill Cos. Inc., cited General Growth’s declining share value. At the close of trading Tuesday, GGP “had a market value of approximately $128 million, ranking 500th in the index,” Standard & Poor’s said. Taking its place in the S&P 500 will be Cephalon Inc. (Nasdaq: CEPH). The Frazer, Pa.-based pharmaceutical company – now a member of the S&P MidCap 400 Index – will move up to the S&P 500 and its biotechnology subindex after the close of trading tomorrow, S&P added.

The news, which sent General Growth shares to a record low of 35 cents, was one more in a series of blows over the past two weeks:

• On Oct. 28, General Growth announced an executive-suite shakeup and said it intended to sell off its Las Vegas retail properties. (READ MORE)

• Last week, the company – which in February posted a 2007 profit of $287.95 million – reported a loss of $15.41 million for the 2008 third quarter. General Growth cited the real estate slump and a resulting decline in land sales in its master-planned communities segment. (READ MORE)

• Then, in a regulatory filing Monday night with the U.S. Securities and Exchange Commission, the company expressed “substantial doubts as to our ability to continue as a going concern.” General growth told the SEC it might seek bankruptcy protection if it is unable to obtain new financing or extensions for billions of dollars in short-term debt, $958 million of which matures this month. (READ MORE)

• General Growth took another hit Tuesday on reports that Circuit City Stores Inc. (NYSE: CC) – which last week had announced plans to close 155 of its 712 U.S. stores, idling 17 percent of its work force (READ MORE) – had filed for Chapter 11 bankruptcy protection in the U.S. Bankruptcy Court in Wilmington, Del. That filing – and a related $1.1 billion line of credit from Bank of America Corp. (NYSE: ) – gave the Richmond, Va.-based electronics retailer “another lease on life,” Chris Horvers, an analyst with J.P. Morgan Securities Inc., wrote in a note to clients, according toBloomberg News. But the bankruptcy filing, which calls for more layoffs and store closings, also fueled fears that General Growth and other retail-center operators will suffer if Circuit City is allowed to terminate leases at some locations.

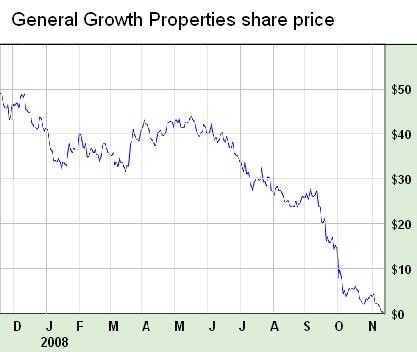

The company, one of the nation’s largest real estate investment trusts (REITs), already had seen its share value dwindle from its March 2007 peak of $65.57 – to $49.95 a year ago and $42.06 six months ago and $25.05 three months ago – despite what it describes as a “stable, high-quality portfolio of real estate assets in good locations.” (READ MORE)

That decline has accelerated since Sept. 12, when GGP closed at $25.57: The shares fell to $5.65 on Oct. 13, $4.14 at the end of October and $2.07 at the close of trading on Friday. And this week, they plunged again, closing at $1.37 on Monday, 48.9 cents on Tuesday and 35 cents yesterday. This morning, the decline continued: At 10:53 a.m., General Growth shares were trading at 33.3 cents – down 1.7 cents, or 4.857 percent, from yesterday’s record low.

General Growth Properties Inc. (NYSE: GGP) – owner of Providence Place and the Silver City Galleria in Taunton and manager of the Swansea Mall – is one of the nation’s largest publicly traded real estate investment trusts (REITs) based on market capitalization. GGP’s portfolio includes about 200 million square feet of retail space and more than 24,000 stores, as well as stakes in various master-planned community developments and commercial office buildings. Additional information is available at www.ggp.com.