PROVIDENCE – A recent analysis of U.S. census information by the National Association of Realtors reveals that homeownership rates have rebounded to 65% across the U.S. from a low of 62.9% in 2016.

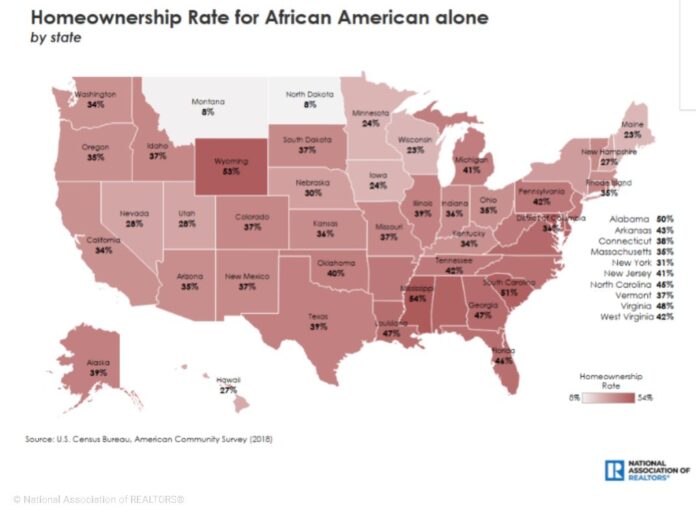

But the rates for owners who are African American or Hispanic have lagged. Just 30% of black Americans had bought a home, as of the third quarter of 2019.

For Hispanic Americans, the homeownership rate has held above 45%, while for Asian Americans, the rate is above 53%.

In Rhode Island, 35% of African Americans own a home, according to the association. This compares to 56% of Asian American families and 31% of Hispanic or Latino families. White families have the highest percentage of home ownership, at 66% in Rhode Island.

The survey data compiled by the association included some financial information associated with the owners by race or ethnicity. Nationally, black homebuyers typically had $38,060 in student loan debt, and 62% were initially rejected for a mortgage because of their debt-to-income ratio.

Asian American buyers typically had $38,000 in student loan debt, and 22% reported being rejected because of an insufficient down payment.

Hispanic or Latino buyers typically had $25,000 in student loans, and 50% said they had been rejected because their credit scores were too low.

White buyers typically had $30,000 in student loans. About 32% said they had been rejected because of their debt-to-income ratio.

Mary MacDonald is a staff writer for the PBN. Contact her at MacDonald@PBN.com.