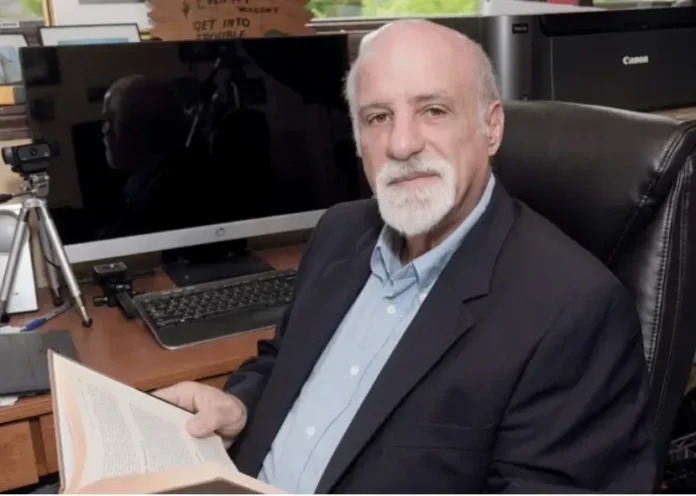

PROVIDENCE – The recent behavior of Rhode Island’s economy in light of new data suggests the “possibility” the state is either moving toward or already in the early stages of a recession, University of Rhode Island economist and professor Leonard Lardaro said Tuesday.

Lardaro said data revisions “totally obliterated my previous assessments of where Rhode Island’s economy is at present.” As a result, the Current Conditions Index that he publishes each month was revised to a neutral value of 50 in December and set to a contractual value of 33 in January. A CCI value above 50 indicates expansion, while a value below 50 indicates contraction.

“January’s economic performance ended a long string of improvements in the CCI, where it had remained in the expansion or neutral ranges since June of 2021,” Lardaro said. “The revised labor market data for Rhode Island were both very disappointing and concerning.”

Lardaro said labor force, resident employment and the unemployment rate registered large negative changes for the second half of 2022, Lardaro said.

“Along with a mind boggling [secular] downtrend in the labor force participation that extends all the way back to late 2006, the official unemployment rate fell all the way to 3.1% in January, even as resident employment … was revised lower and was in a downtrend throughout the second half of last year,” Lardaro said.

Although payroll employment did not see dramatically lower values, it still remains below its pre-pandemic high and has fallen back to an earlier peak in Dec. 2006, and has trended downward since August, Lardaro said.

“Current Conditions Index values for much of last year were revised: There were three upward revisions and six downward revisions, almost all of which occurred since August,” Lardaro said.

Lardaro said new claims started to rise over the past two months and new home construction has been declining for some time. Total manufacturing hours, declined in January along with U.S. consumer sentiment. Employment service jobs declined on a monthly basis for seven consecutive months and twice based on year-earlier values.

Retail sales, the statistic Lardaro said he feared would eventually go negative, fell relative to a year ago in dollar terms for the first time since June 2020.

“As has now become all too apparent, the monthly CCI’s behavior along with weakness in the leading indicators contained in the CCI correctly signaled that problems were in our future,” Lardaro said. “As it turns out, unbeknown to us, we were already experiencing these issues throughout most of the second half of 2022.”

Lardaro said it is still too early to determine if Rhode Island will see a recession.

“Clearly, data will be revised, hopefully higher, and new data might be stronger. But that is not at all certain given the combination of a slowing national economy and monetary tightening, many of whose effects we have yet to feel,” Lardaro said. “Working against us is the fact that Rhode Island has historically suffered from FILO [First In, Last Out]. So, we could be witnessing [the beginning of that], which is not entirely unrealistic to assume. Let’s hope not. Unfortunately, we won’t know this for a while.”

Year-over-year CCI indicator performance in January:

- Government employment declined 1.3%

- U.S. consumer sentiment declined 25.5%

- Single-unit permits declined 43.2%

- Retail sales declined 0.7%

- Employment-services jobs declined 11.7%

- Private-services production employment rose 1.7%

- Total manufacturing hours declined 0.3%

- The state’s manufacturing wage rose 3.6%

- Unemployment benefit exhaustions declined by 27.7%

- New unemployment insurance claims increased 18.2%

- The state labor force declined 0.6%

- Unemployment rate declined 0.4%.